UPI is now available for NRIs

International mobile numbers can be used to make UPI payments.

The Unified Payments Interface (UPI) is a revolutionary digital payment system launched by the National Payments Corporation of India (NPCI) in 2016.

It has transformed India’s banking landscape by making financial transactions simple, fast, and secure.

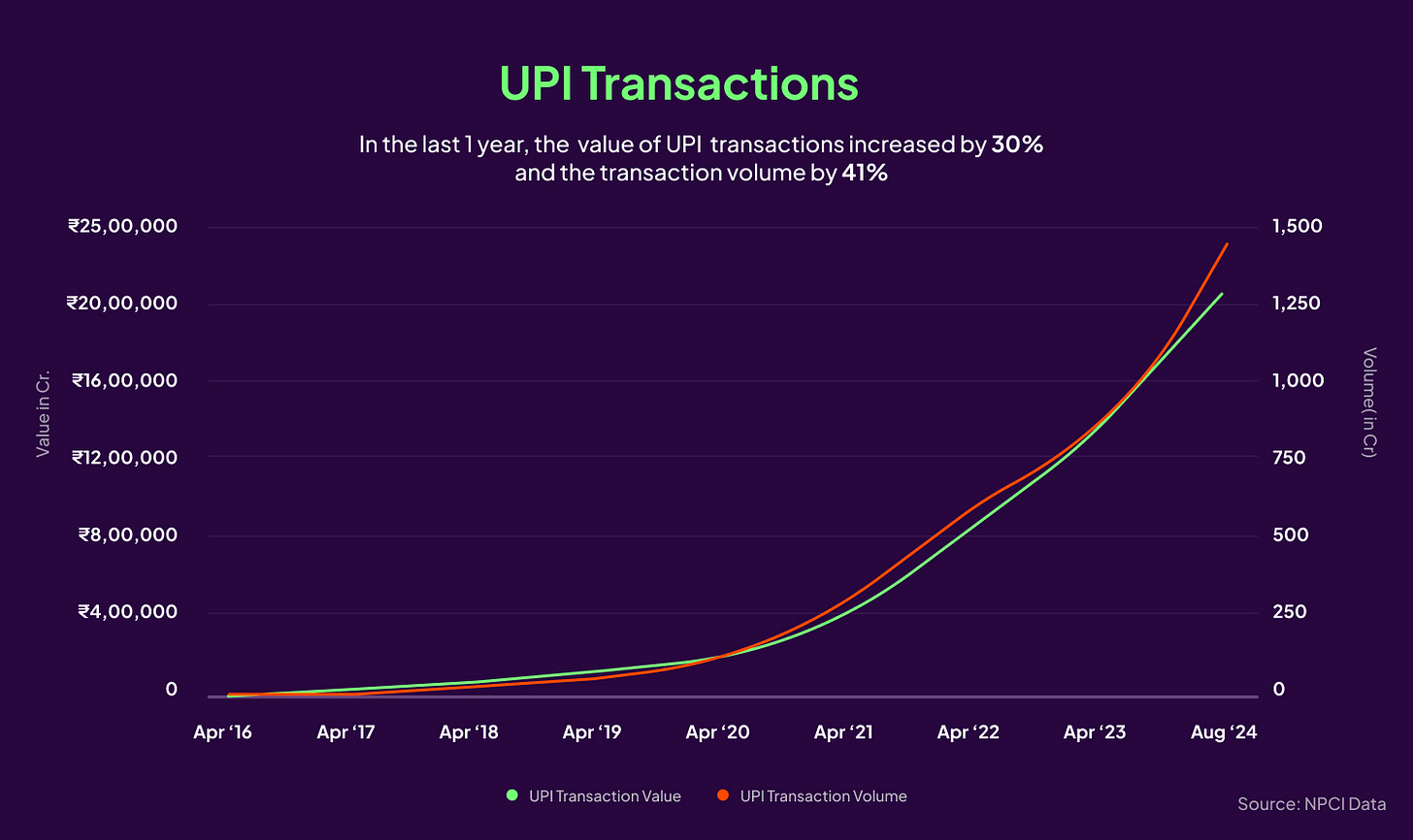

In August 2024, the number of UPI transactions equaled 14,963.05 million, a 41% increase from the previous year. And, The value of transactions stood at Rs 20.6 lakh crore, a 30% increase year on year.

Now, this game-changing platform is available for Non-Resident Indians (NRIs), enabling them to make UPI transactions directly using their international mobile numbers. This is a significant breakthrough for NRIs, who frequently need to manage payments in India.

And, not just that, if you are visiting India, you can easily transact through UPI, just like a resident Indian. Either scan or transfer money to a UPI ID. Isn’t that a breather for all your Indian expenses without having to worry about arranging for money?

ICICI Bank Leads the Way

ICICI Bank is the first to roll out this feature, allowing NRIs to use UPI with their international numbers through the iMobile Pay app. Previously, NRIs needed an Indian mobile number linked to their account to use UPI, but with this update, they can use their international numbers across more than 15 countries, including the USA, UK, UAE, and Canada, among others.

Setting Up UPI with Your International Number

Setting up UPI with an international number is simple. Here’s how you can do it if you're an ICICI Bank customer:

Download the iMobile Pay App: Log in using your credentials.

Navigate to UPI Payments: Tap on the ‘UPI Payments’ section.

Verify Your Mobile Number: The app will prompt you to verify your international mobile number linked to your NRE/NRO account.

Create a UPI ID: In the 'Manage' section under 'My Profile', create a UPI ID from the available options.

Link Your Account: Select your NRE or NRO account to link with the UPI ID, and you're all set.

Once you set up your UPI, you can use it to make payments or receive funds. You must scan a QR code, send money to the mobile number linked to UPI, or directly send funds to a UPI ID. You can also transfer funds by providing bank account details.

UPI Transaction Limits

It is important to remember that UPI doesn't allow unlimited daily transfers. There is also a transaction limit that you must adhere to. According to NPCI guidelines, the per day UPI transaction limit is set at INR 1 lakh cumulative transaction value or a maximum of 20 transactions.

However, in the case of a new UPI/VPA ID registration, the limit is INR 5,000 for the first 24 hours. After 24 hours, the limit is reset to INR 1,00,000.

The number of transactions and transaction limit vary from bank to bank. Hence, it is best to check with your bank regarding the UPI limits, as they change from time to time.

What Transactions Can NRIs Perform?

Once you’ve set up UPI, you can perform several financial transactions:

Pay Utility Bills: Manage utility bills like electricity and phone payments directly from your overseas account.

Send Money to Family/Friends: Seamlessly transfer money to family or friends by using their UPI ID or mobile number.

Merchant Payments: Whether shopping online or in India, you can make payments by scanning a QR code or using UPI.

Direct Bank Transfers: You can send money directly to any Indian bank account

The Benefits of UPI for NRIs

UPI’s global expansion makes managing finances in India smoother than ever. You can now send money instantly, pay bills, or shop in India, all while residing abroad. With ICICI's feature, there is no need for an Indian mobile number, making the process hassle-free. Moreover, all transactions are conducted in Indian Rupees (INR), and the service is secure with two-factor authentication.

Easy and convenient transactions: Making payments to India has never been easier and faster. Through UPI, you can pay anyone in India within minutes without the hassle of using traditional remittance methods.

Lower fees: Compared to the existing remittance methods, sending money through UPI is very cost-effective, as the fees are either low or zero.

Security: UPI uses advanced encryption technology to protect user and transaction data. Hence, making payments through UPI is considered very safe.

Accessibility: UPI payments are widely accepted in India, making it very easy to send money to friends and family for purchases.

Real-time tracking: You can track your transactions in real-time, making monitoring your payments and receipts easy.

Backed by government: UPI is backed by the government, which provides ongoing support and development to ensure continued growth and success.

List of Countries Supporting UPI Payments

NRIs residing in the following countries have the facility to use UPI for payments and receipts:

Australia

Canada

France

Germany

Hong Kong

Malaysia

Netherlands

New Zealand

Oman

Qatar

Saudi Arabia

Singapore

South Africa

United Arab Emirates

United Kingdom

United States of America

Do share this newsletter with your NRI friends and family who might looking to set up UPI transactions.

Best,

iNRI Team