Systematic Withdrawal Plan (SWP) in Mutual Funds

Effectively manage your mutual fund withdrawals with SWP.

Are you looking for a regular source of income in India - be it for yourself or to support your family back home? Systematic Withdrawal Plan (SWP) can easily help you generate a regular source of income. Wondering how? Don't worry; we’ll break down the concept for you in this newsletter.

What is a Systematic Withdrawal Plan (SWP) in Mutual Funds?

A Systematic Withdrawal Plan (SWP) is a type of plan that allows you to withdraw fixed or incremental amounts at selected regular intervals, either monthly, quarterly, or annually while investing in mutual fund schemes. To generate the desired cash flow, you will be redeeming units of the mutual fund scheme at chosen intervals.

How Does SWP Work?

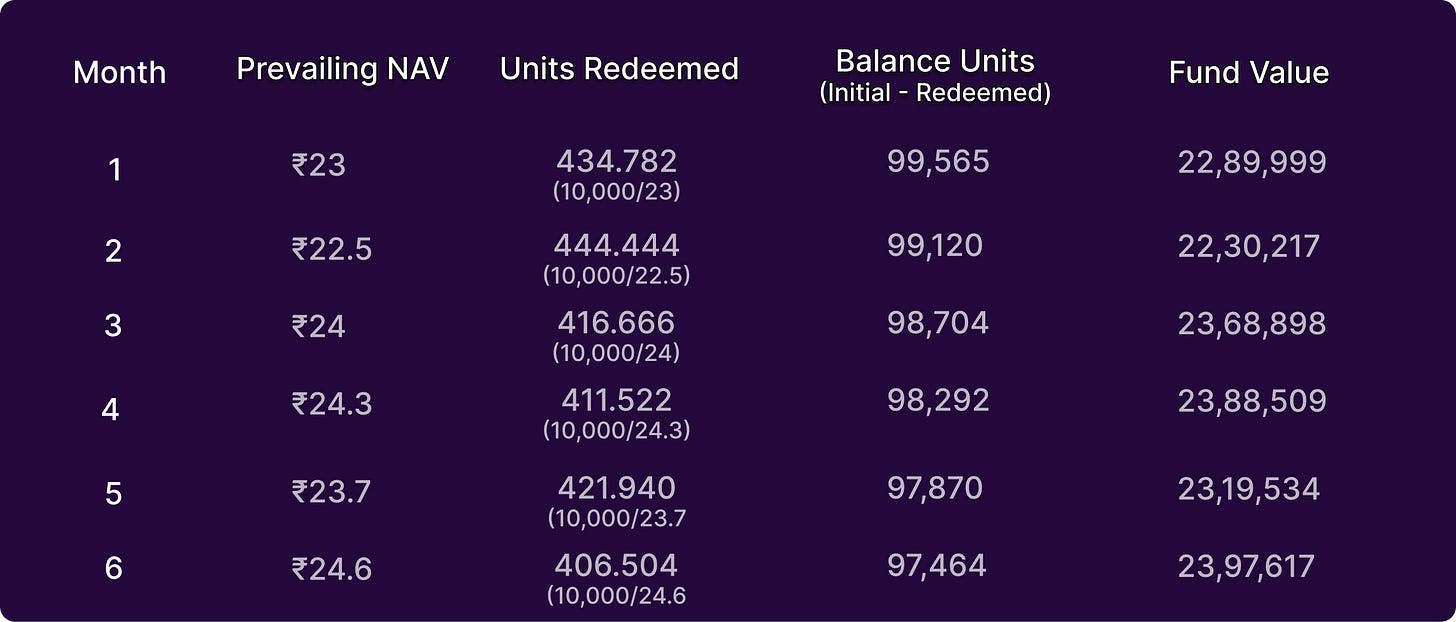

Let's understand this with an example. Assume you invest ₹20 lacs in a mutual fund and opt for the SWP Plan. You set up a monthly withdrawal of ₹10,000 starting one year after the investment date to avoid exit load. At the time of purchase, the Net Asset Value (NAV) was ₹20, so you acquired 1,00,000 units.

The table below explains how units are redeemed after one year to provide you with regular cash flows:

This process continues until the end of the SWP period you chose or till the fund lasts. You can withdraw any remaining balance at the end of the period.

Note: If the scheme NAV appreciates at a percentage higher than the withdrawal rate, your capital remains the same or grows. If the withdrawal amounts are higher, you are essentially withdrawing part of the capital as well.

How SWP Can Be Better Than FD?

SWP in equity-oriented mutual funds can be more tax-efficient and profitable than a Fixed Deposit (FD), especially for long-term investors. SWPs benefit from favorable tax treatment, with long-term capital gains up to ₹1.25 lakh tax-free annually, and anything above this threshold is taxed at only 12.50%. In contrast, FD interest is fully taxed at the investor’s highest tax bracket, often around 30%, which reduces net returns significantly.

SWPs also offer higher growth potential, as investments are equity-linked, allowing for compounding and inflation-adjusted growth. Additionally, SWPs provide flexibility, letting you control withdrawal amounts and timing without penalties, unlike the fixed tenure of FDs.

Overall, SWPs are better than FD if you are seeking efficient tax treatment, inflation protection, and flexibility.

Conclusion

SWP has gained traction in the past few years and is suitable for everyone, whether you are retired, a working professional, or facing an unexpected career break. It offers flexibility, tax efficiency, and regular income, making it an attractive option for managing cash flow needs.

You can read our detailed blog post to understand SWP in depth.

Blog - https://www.goinri.com/blog/systematic-withdrawal-plan-swp