PMS 101: A Smarter Way for NRIs to Invest in India

Personalized portfolios. Expert management. Built for global Indians.

Looking to go beyond mutual funds and take control of your India-focused investments?

Portfolio Management Services (PMS) gives NRIs access to professionally managed, custom-built portfolios — tailored to your goals, risk profile, and global tax needs.

Here’s what you need to know:

What is PMS for NRIs?

PMS is a SEBI-regulated investment service where expert fund managers build and actively manage a portfolio in your name — ideal for NRIs with ₹50L+ to invest.

🌍 Invest from anywhere — via NRE/NRO or Gift City

📈 Own stocks directly — not pooled like mutual funds

🧠 Get a personalized strategy — not one-size-fits-all

Different Types of Portfolio Management Services

Discretionary PMS: The portfolio manager makes buy/sell decisions on your behalf, based on your risk profile.

Non-Discretionary PMS: The manager suggests investments, but you have the final say before execution.

Advisory PMS: The manager offers periodic advice, and you handle the execution.

Why Invest in PMS?

If you’re looking for a more personalized, performance-focused way to invest in Indian markets, Portfolio Management Services (PMS) offer an edge over traditional options like mutual funds. PMS gives you direct ownership of high-quality stocks, actively managed by seasoned fund managers, and tailored to your goals, risk appetite, and global tax needs.

A Note for U.S.-Based NRIs:

Unlike mutual funds, PMS is not classified as a PFIC (Passive Foreign Investment Company) for U.S. tax purposes. That means no complicated Form 8621 filing, no punitive PFIC taxation, and a far more efficient way to grow wealth in India while staying compliant with the IRS. For many Indian-origin investors in the U.S., this alone makes PMS a better long-term strategy.

Factors To Consider Before Selecting a PMS Provider

Track record and performance consistency over market cycles

Strategy alignment with your risk and goals (e.g., value, growth, flexicap)

Fee structure — fixed, variable, or performance-linked

Transparency in reporting and access to fund manager

Tax efficiency — especially important for NRIs under DTAA

Compliance & Custody — ensure SEBI registration and reputed custodians

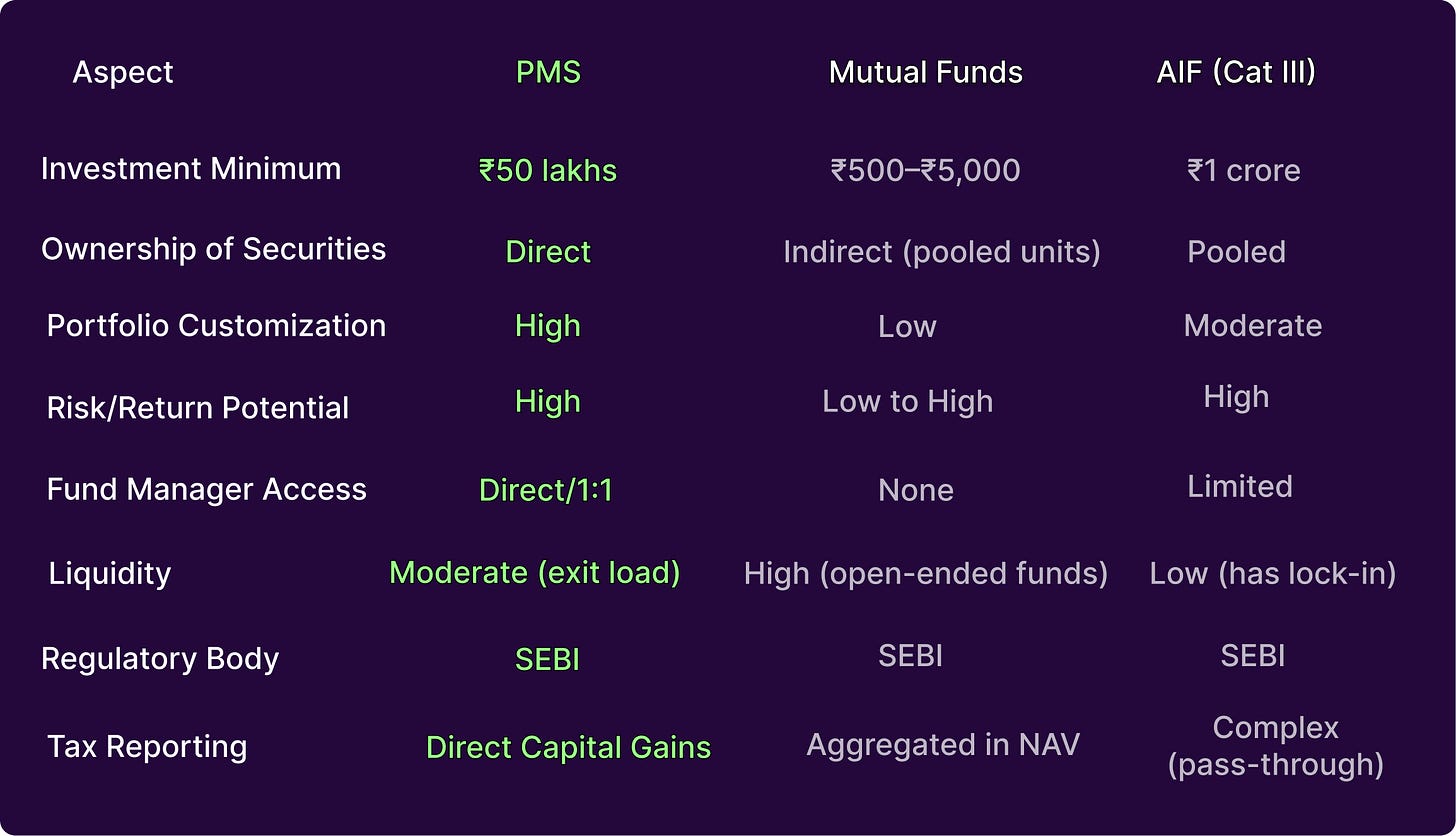

PMS vs Mutual Funds vs AIFs*

*Alternate Investment Funds

🎓 Want to Learn More? Join Our Live Webinar!

Join us for a live webinar on PMS 101 for NRIs – Featuring experts from CapitalMind PMS.

Register Now: https://lu.ma/pms-101-for-nris

📅 Date: May 18, 2025

🕙 Time: 10 AM PT | 10:30 PM IST

Register Now: https://lu.ma/pms-101-for-nris

👉 Learn the basics of PMS

👉 Understand tax advantages for NRIs

👉 Get your questions answered live during our expert Q&A