Planning Your Return to India: Find Your NRI FIRE Number

Calculate your FIRE number for a stress-free retirement

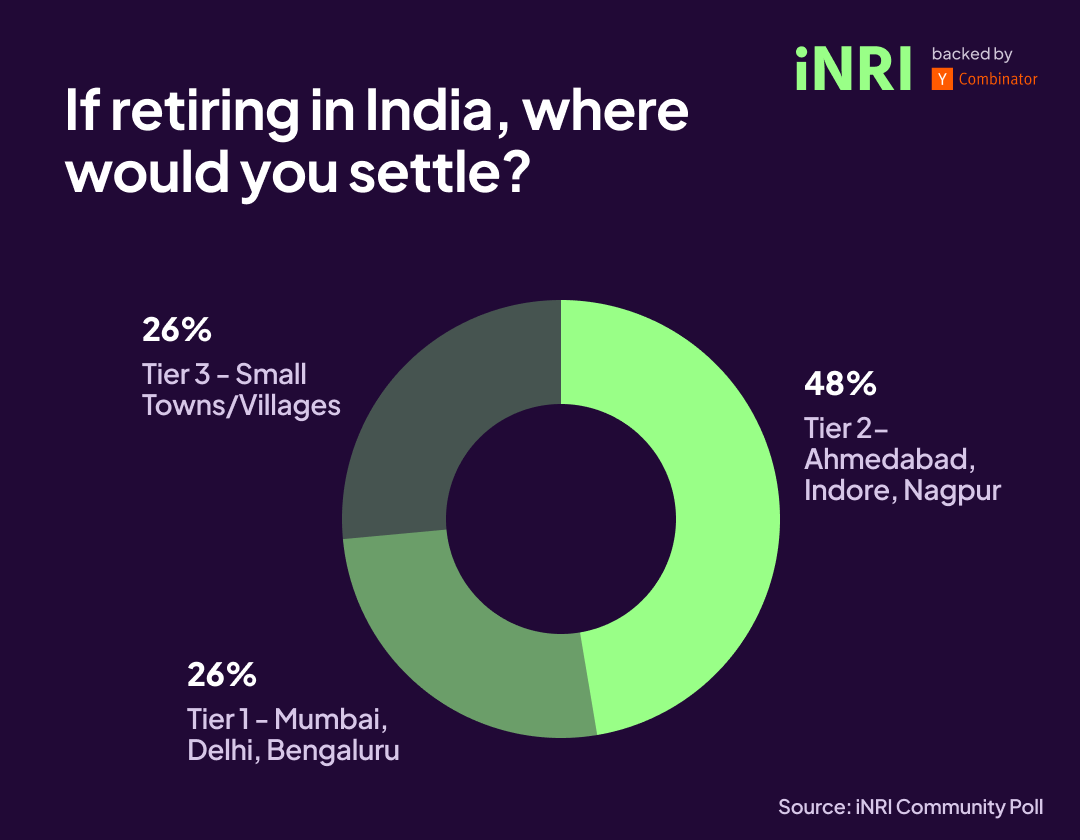

In a recent poll conducted within our NRI community, 65% of respondents expressed their desire to retire in India, with nearly 50% choosing Tier 2 cities as their retirement destination. This brings us to an important question: How much money do you need to retire in India? More specifically, how can you determine if you have enough saved for a comfortable retirement? For this, let’s first understand FIRE.

What is FIRE?

FIRE - Financial Independence, Retire Early - a movement that’s taken the world by storm. It’s all about aggressive saving and smart investing to achieve financial freedom sooner than you think. Let’s find out your FIRE number and map out your return to India.

The essence of the FIRE philosophy is to accumulate enough wealth so that your investments can generate enough passive income to cover your living expenses, allowing you to retire from your traditional 9-to-5 job well before the standard retirement age.

To achieve this, you must calculate your FIRE Number—the amount required to cover your living expenses annually, multiplied by 25. This “25x rule” is based on the widely accepted principle that withdrawing 4% of your investments annually is a sustainable way to fund your retirement over the long term.

Then there is Lean Fire, Fire, and Fat Fire

What are they?

Lean FIRE: Retire early with a minimalist lifestyle by keeping expenses low, typically requiring 20x annual living costs. You may or may not need an additional source of income just to cover your expenses. Suitable for modest living possibly in low-cost areas like Tier 3 cities.

FIRE: Achieve financial independence with a comfortable lifestyle, needing around 25x annual expenses. It balances comfortable and moderate spending. Suitable if you are aiming for a balanced lifestyle with occasional luxuries in Tier 2 cities.

Fat FIRE: Retire early with a luxurious lifestyle, requiring 50x annual living costs. Best for those wanting a high standard of living and financial security. Suitable if you wish to retire in expensive cities, or have a large safety net for unexpected expenses.

What is my FIRE number if I want to retire today?

Let’s find out,

Your FIRE number will depend on various factors, including your age, expected expenses, lifestyle, and, most importantly, where you plan to retire.

Let’s say you plan to retire today. And, your currently monthly expenses are Rs 1,00,000.

That makes your annual expenses - Rs 12 lakhs

FIRE Number = Rs 12 lakhs * 25 = Rs 3Cr

Is this FIRE Number the same across India?

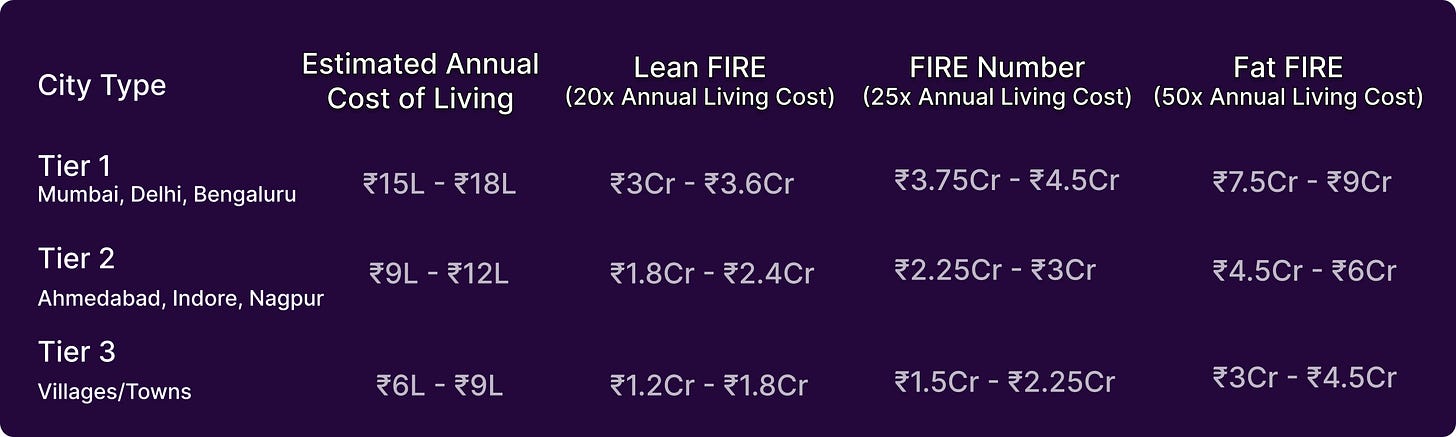

Not all retirement destinations are created equal, especially regarding the cost of living. Tier 1 cities like Mumbai and Delhi are significantly more expensive than Tier 2 or Tier 3 cities.

As you can see, where you choose to retire in India significantly determines your FIRE number. Tier 1 cities demand a much higher retirement corpus due to their higher cost of living. In contrast, Tier 2 and Tier 3 cities provide a more affordable option without compromising too much on lifestyle.

How Should You Be Investing?

If you've paid off your home in India and secured your children's education, now is the perfect time to focus on your FIRE (Financial Independence, Retire Early) number. Building a diversified investment portfolio with a mix of equity, debt, gold, and real estate can provide a well-balanced, risk-adjusted strategy.

By starting your investments in India early, you can avoid the hassle of moving assets later and benefit from the country's economic growth. Indian Mutual Funds, in particular, offer a simple way to tap into this potential. For instance, a typical equity mutual fund has grown by 25% in the past year alone, and with the economy expected to expand over the next decade, compounding returns can significantly accelerate your path to FIRE.

With iNRI, you can invest in Indian Mutual Funds entirely online, making it easier to reach your financial independence goals faster than you might expect.

Until Next Time

Team iNRI