NIFTY@ 25k: Are We Sitting On A Bubble?

Nifty and Sensex hit a record high on 1st Aug'24.

On Thursday (August 1, 2024), the NIFTY and Sensex hit an all-time high of 25,078.30 and 82,129.49, respectively. The journey from 24,000 to 25,000 took just 24 trading sessions - the third-fastest 1,000-point rally on Dalal Street and guess what? Nifty is up by almost 17% this year, making it one of the best-performing emerging markets globally.

Today, let’s look at some of the factors that we think are driving this market rally

The first one being, the newly formed Government: Modi 3.0 has driven investor confidence due to policy continuity.

Positive global outlook: The US Federal Reserve plans to cut rates in September, boosting investor confidence. This indicates that inflation is gradually being brought under control

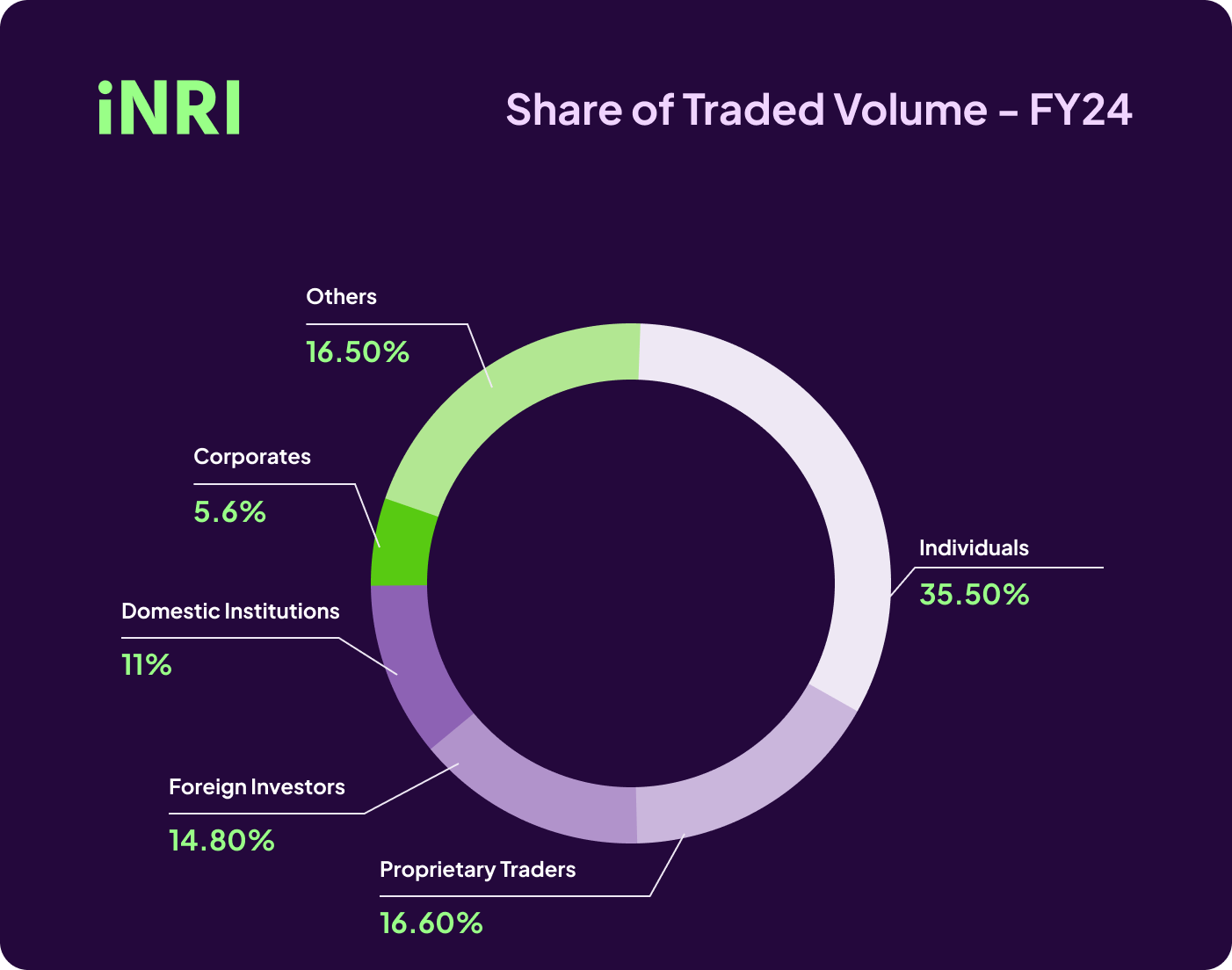

Increased domestic investors: The number of domestic retail (people like you and me) & domestic institutional investors in the Indian Equity market has significantly increased post COVID. Whopping, 42 lakh new demat accounts were opened in just June 2024 alone; currently, totalling more than 16 crore accounts.

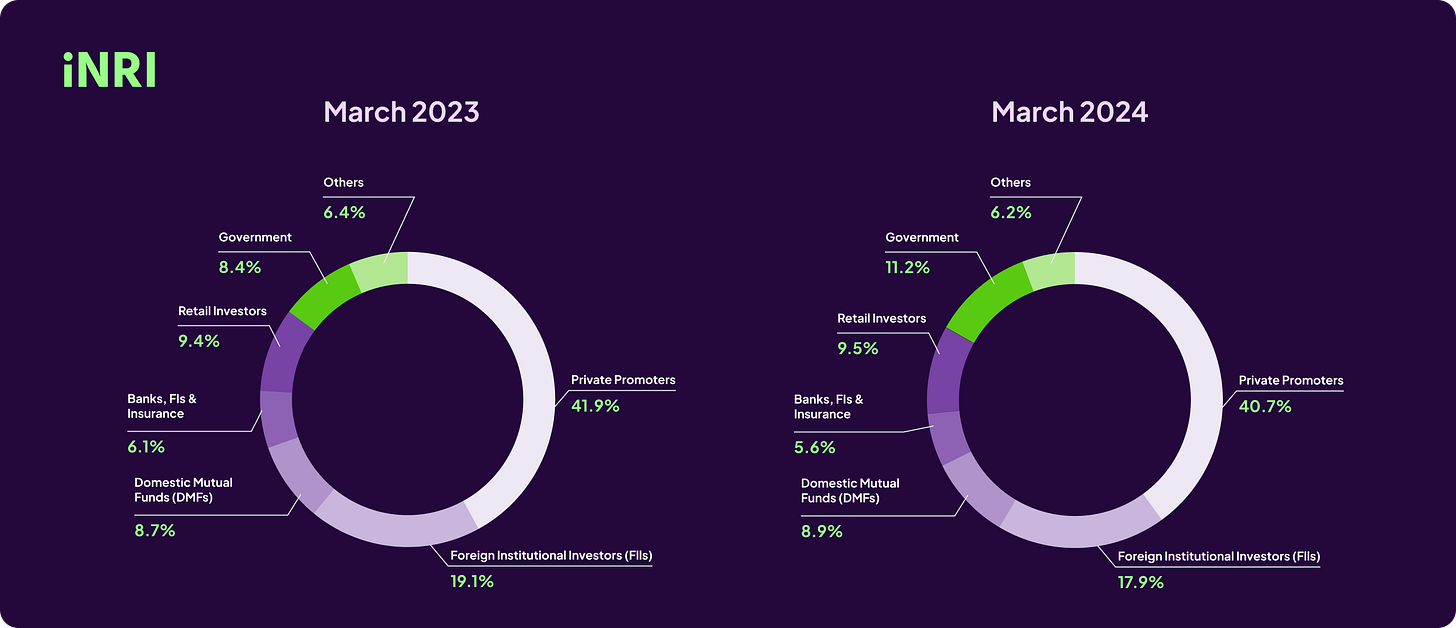

Despite having only a 9.5% share, retail investors are the most active traders, indicating their significant influence on market movements.

Not just stock trading, mutual funds have also witnessed significant inflows. In June 2024, Mutual fund systematic investment plan (SIP) contributions hit a record high of Rs. 21,262 crore & the assets under management (AUM) for mutual funds grew by 4%.

We also dug a little deeper to understand what is really driving so much of retail participation. Here are some major drivers.

Shift in saving preferences - More people are now drawn the allure of bigger returns in the Mutual Funds & stock markets compared to the traditional bank FDs and other vehicles.

Digital proliferation - With UPI apps, banking apps & many other neo banks now allowing Mutual Fund Investments through their apps making investing accessible to almost all of them.

Decreased dependency on Foreign Investors - The last major reason is the decreased market dependency on Foreign Investors like we used to. FII (Foreign Institutional Investors) has declined from 20.7 in 2021 to 17.9 in 2024.

In 2013, the market faced a significant turmoil. Sensex Dropped 15% in just 3 months, INR fell from 53 to 68 against the dollar very quickly. Adding to all that, $5 billion was pulled by the US Federal Reserve, which further impacted the market liquidity & stability. Times have changed, and FIIs are no longer riding the Indian markets the way they used to.

The recent surge in NIFTY and SENSEX reflects global optimism and robust retail participation. While history cautions against potential market volatility, the increasing involvement of domestic investors has made the market more resilient against foreign investment fluctuations.

What else do you think is driving this dream run in the Indian markets?