Mutual Funds vs ULIPs for NRIs: Where to Invest?

Here's a comparison between their features, benefits, and risks.

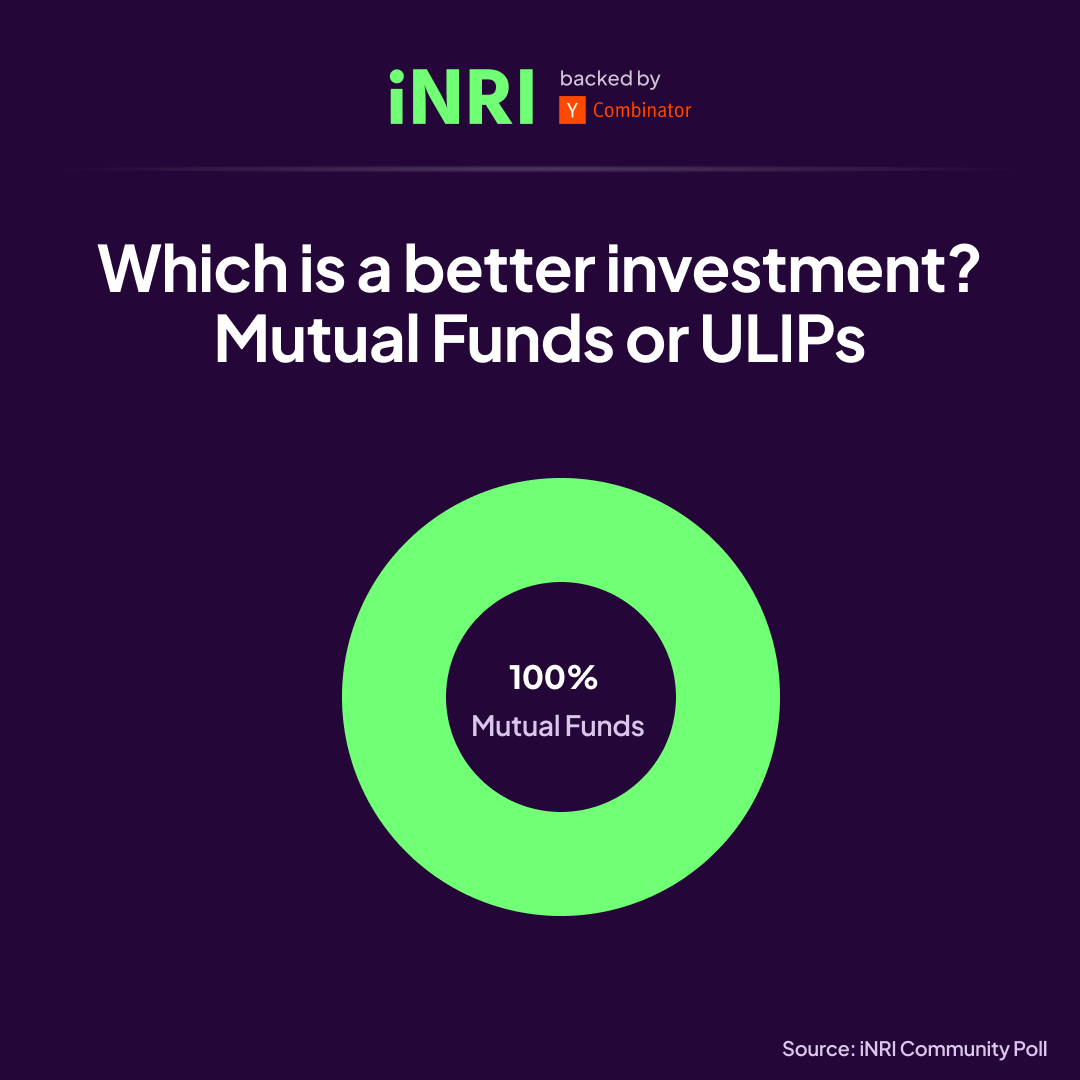

This week, we did an iNRI survey with our community members to understand how NRIs feel about which is a better investment - Mutual Funds or ULIPs.

Surprisingly, 100% of them are of the opinion that mutual funds are a better investment option than ULIPs.

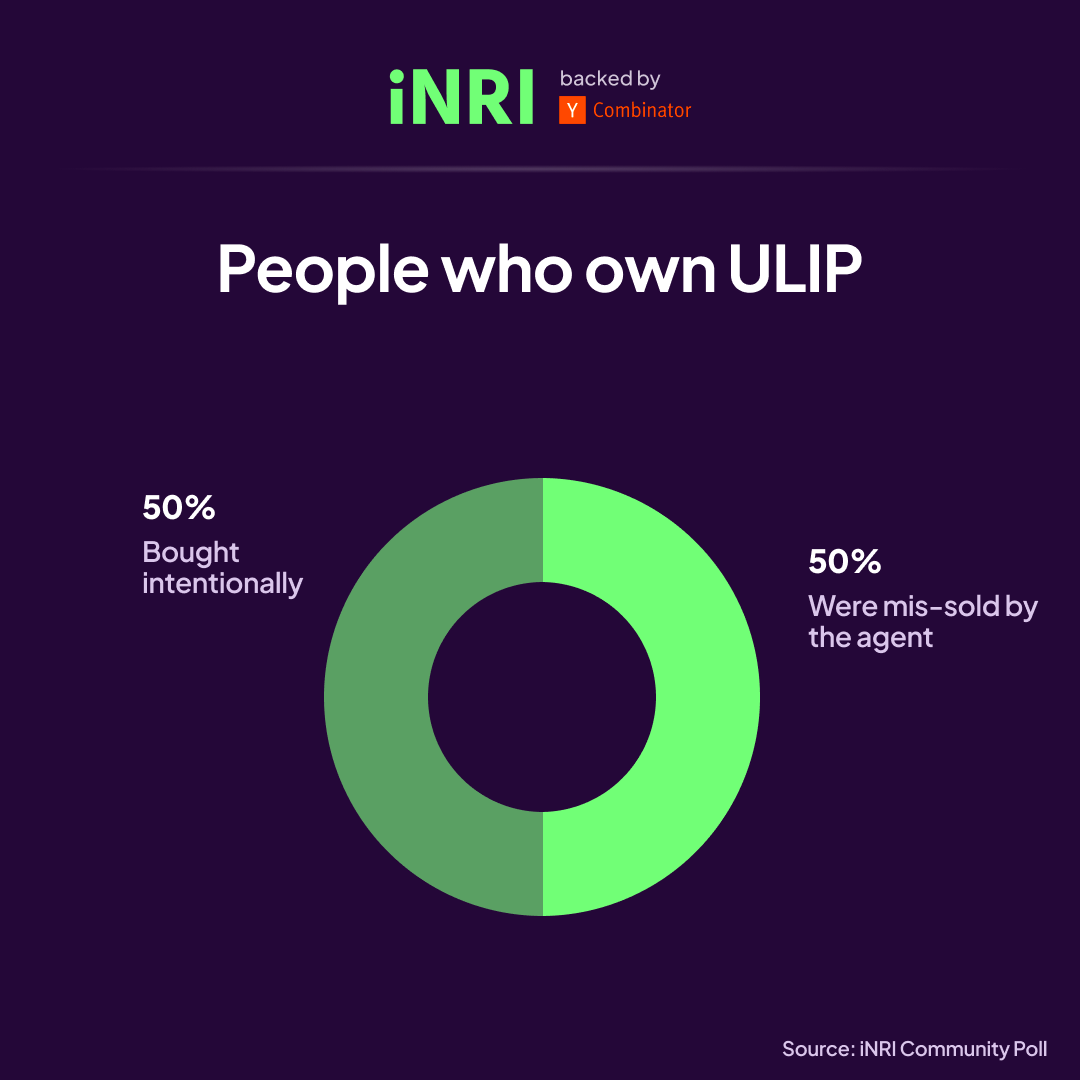

And, not just that, for those who have purchased ULIPs in the past 50% feel that they have been mis-sold by the agent.

This just reiterates the fact that ULIPs are mis-sold by agents in India only because they earn higher commissions on the product. ULIPs have hidden charges that most investors are unaware of, which significantly lowers their investment return.

While both can grow your wealth, they serve different purposes and come with distinct features.

To help you make an informed decision, we’ve put together a quick guide that compares Mutual Funds and ULIPs, focusing on key factors like returns, flexibility, costs, and tax benefits.

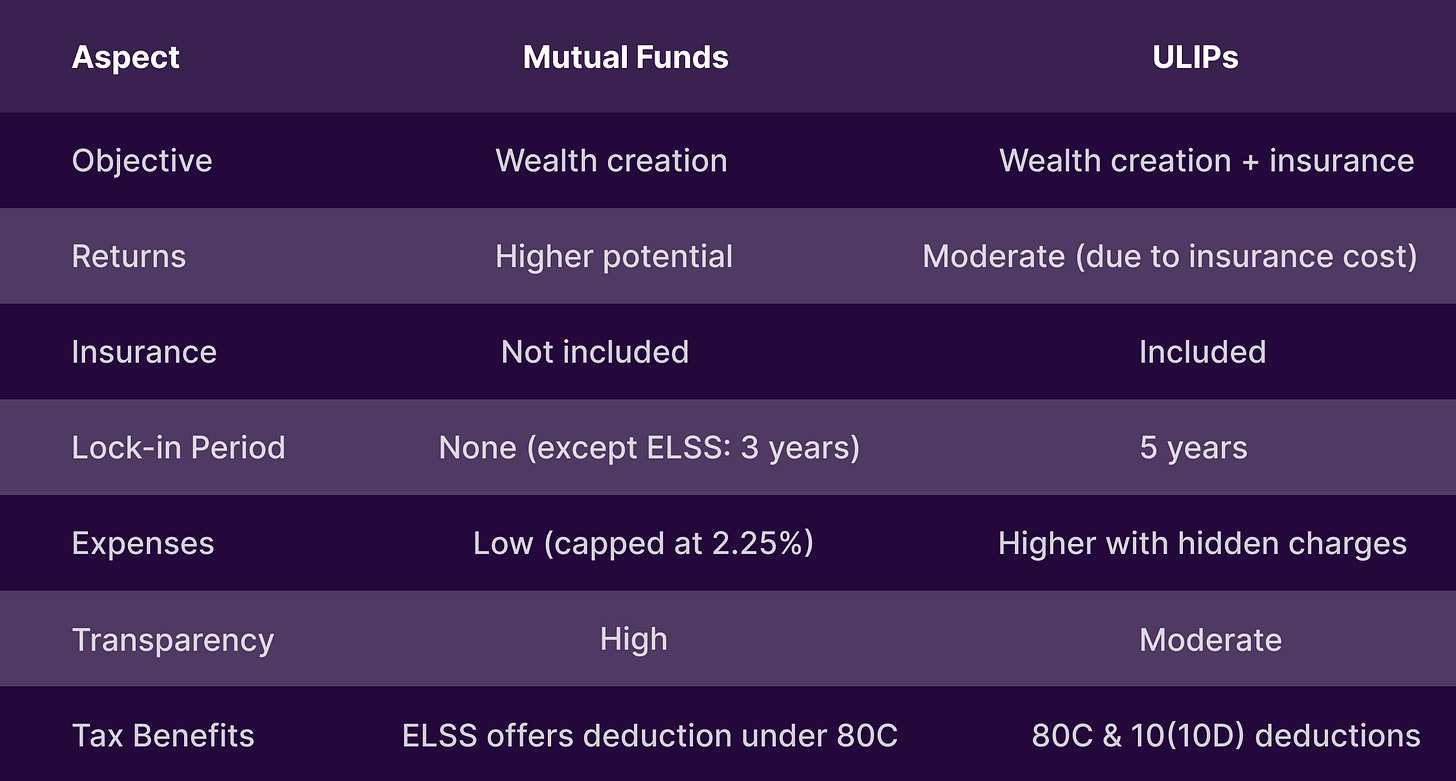

A Quick Comparison

Which is Better for NRIs?

When it comes to choosing between mutual Funds and ULIPs, Mutual Funds are a clear winner. While ULIPs offer the dual benefit of insurance and investment, mutual funds focus purely on wealth creation, making them a more straightforward and cost-effective option. With better returns, greater liquidity, and lower expenses, Mutual Funds provide a clear edge for those looking to maximize their financial growth without the added complexity of insurance.

Mutual Funds are ideal because:

High liquidity: Easy to enter and exit.

Flexibility: Various fund types for different goals.

Potential for high returns.

Tax-saving options with ELSS Funds (Equity Linked Savings Scheme).

Professionally managed.

ULIPs might be better because:

Insurance + Investment: Combines life cover with investment growth.

Tax benefits under Section 80C and 10(10D).

Flexibility to switch between funds.

4G ULIPs offer greater flexibility in fund selection.

4G ULIPs are a new category that offers more flexibility than traditional ULIPs. For example, instead of investing in one fund, investors can choose to invest in multiple funds within the same policy.

What are Mutual Funds?

Mutual Funds pool money from multiple investors and invest in equities, debt, or a mix of both, depending on the fund type. Managed by professional fund managers, they offer a range of options based on your risk tolerance and investment horizon.

What are ULIPs?

ULIPs offer the dual advantage of insurance coverage and investment. They allow you to invest in equity, debt, or a combination while also providing life insurance. ULIPs have a lock-in period of 5 years and are designed for long-term goals.

Factors to Consider Before Choosing

Objective: Mutual Funds focus solely on wealth creation, while ULIPs combine insurance and investment. If dual benefits are a priority, ULIPs are a better fit.

Returns: If you aim for higher returns and are comfortable with market risks, Mutual Funds have historically performed better.

Flexibility: Mutual Funds offer greater liquidity and flexibility in terms of withdrawals, investment modes (lump sum or SIP), and fund-switching options. ULIPs, with their lock-in period, are less flexible.

Expenses: Mutual Funds are more cost-efficient with transparent fee structures, while ULIPs have higher, often hidden charges.

Tax Benefits: ULIPs offer broader tax advantages under Section 80C, but only ELSS Mutual Funds provide tax savings.

A point to note: Section 80C is only available as part of Old tax regime filing.

Bottom line

It’s always recommended to keep your insurance and investment needs separate. The high hidden charges of ULIPs work against you in the long term. It's best to buy a term plan for your insurance needs and invest in mutual funds for your investment needs. This strategy will also give you more flexibility while also having more control over your investment style.