Longer SIPs = Better Returns? Lets find out…

The Longer You Stay, The Better You Earn

We all hear it—"Invest for the long term." But what does long-term actually mean? Is 5 years enough? Or should you stay invested for 10+ years?

More importantly, does the definition of long-term change for large-cap, mid-cap, and small-cap funds?

We've summarized highlights from the research conducted by ValueMetrics by analyzing 20 years of SIP returns across different market segments. Here’s what the data reveals:

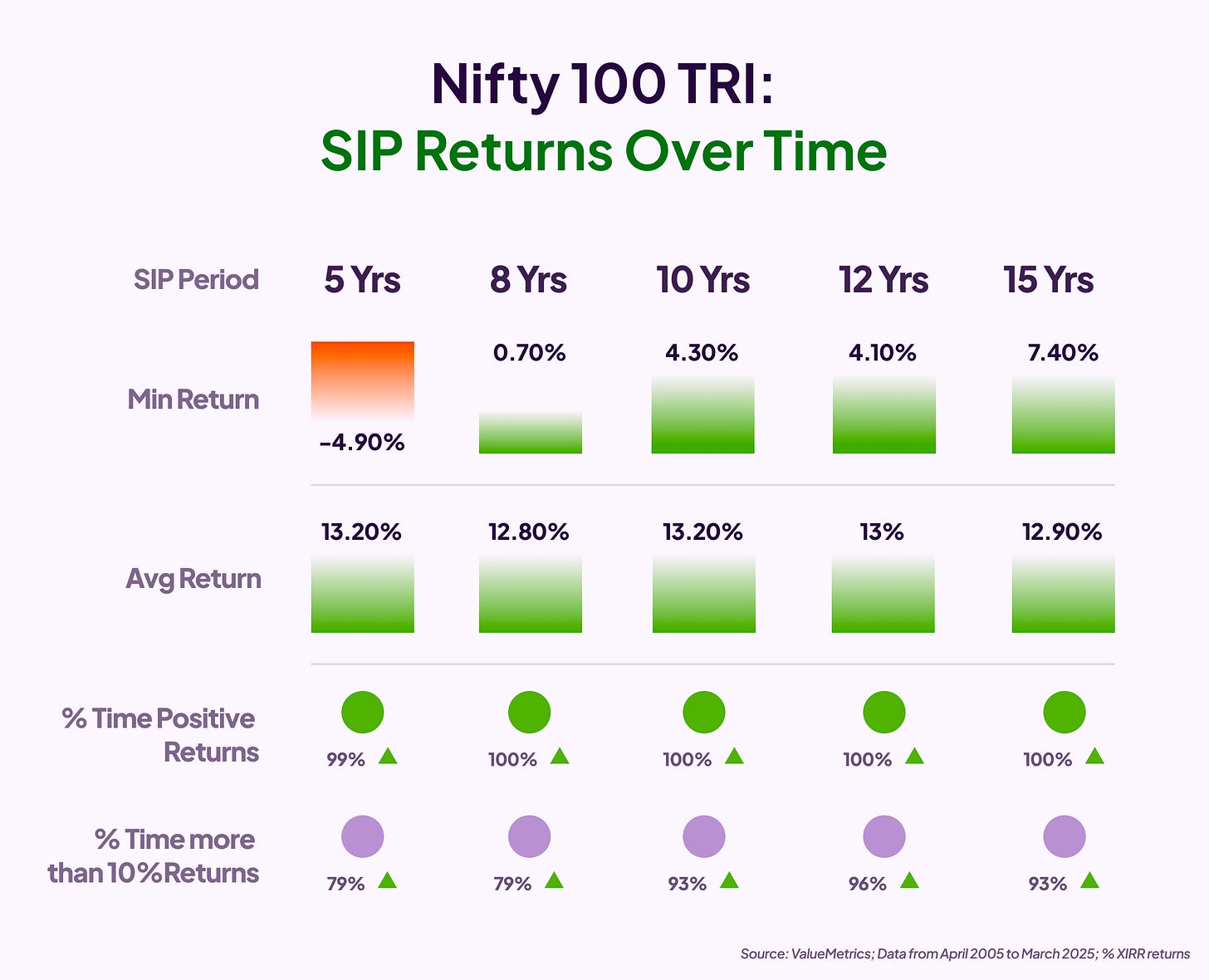

Large Cap Funds: 8+ Years for Stability

Many investors think 5 years is long-term, but the data suggests 8 years is the real stress-free zone.

Anyone who invested for 8+ years never lost money.

At 10+ years, 93% of investors earned over 10% annualized returns, making it one of the most stable options for long-term investing.

Key takeaway: If you want steady and predictable returns with minimal risk, large caps deliver with time.

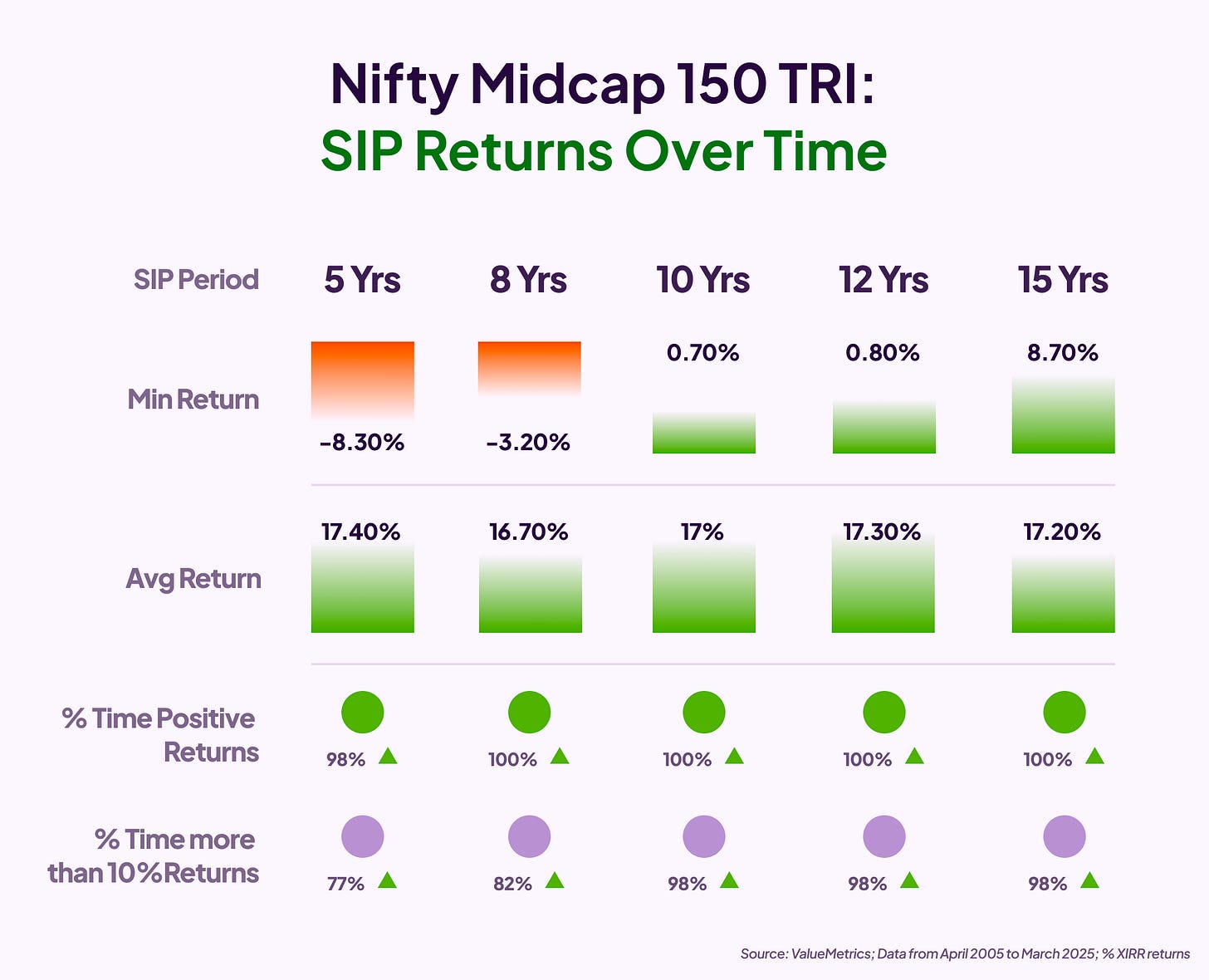

Mid Cap Funds: 10 Years is the Sweet Spot

If you invest for less than 8 years, losses are possible.

However, hold for 10 years, and negative returns drop to zero.

The probability of earning over 10% jumps to 98% after a decade.

Key takeaway: Mid-caps reward patience. Short-term investors face volatility, but those who commit for 10+ years see the biggest rewards.

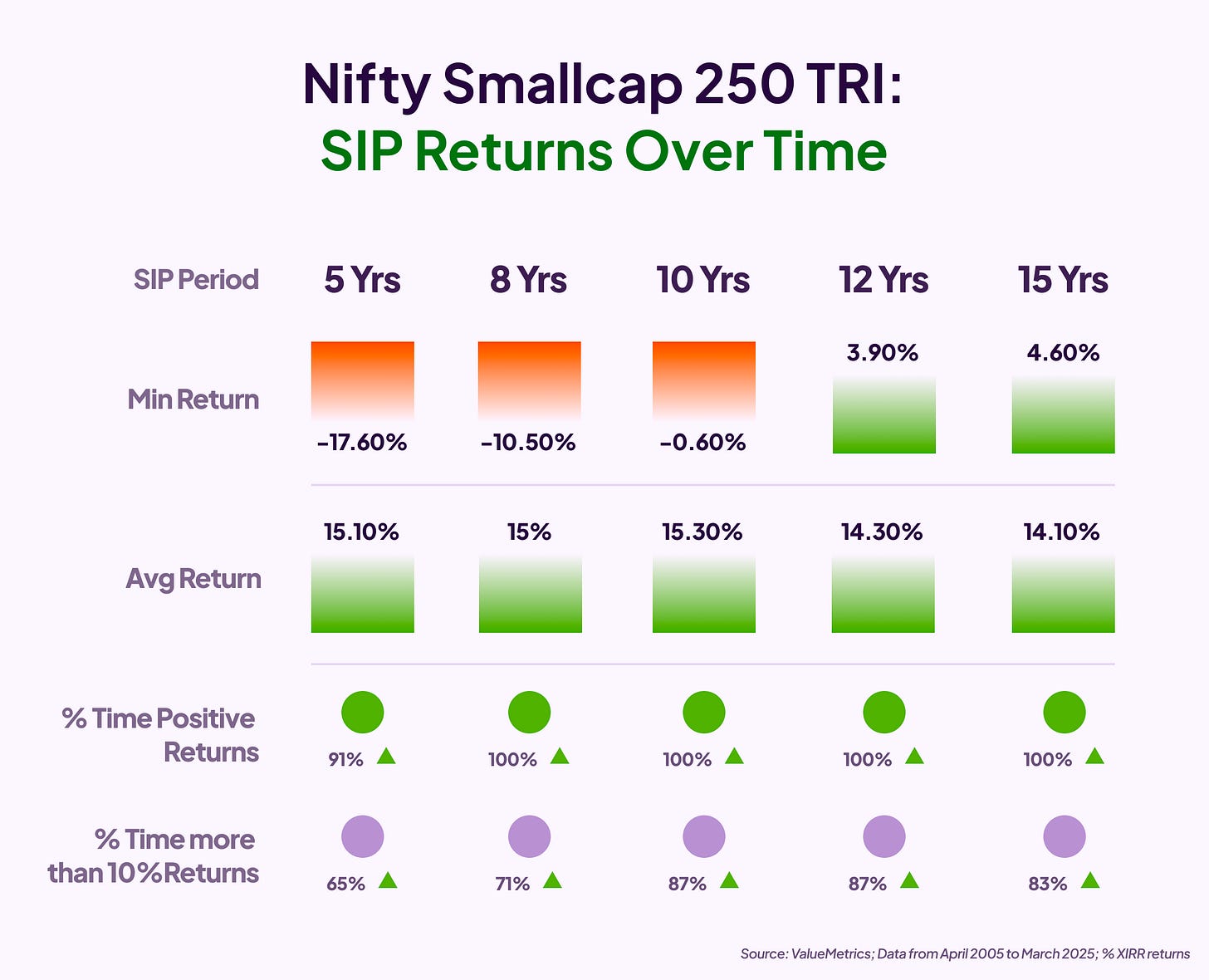

Small Cap Funds: Even 10 Years Can Be a Wild Ride

Small caps are high-risk in the short term, but time reduces the uncertainty.

Even after 10 years, there’s still a chance of losses—unlike large and mid-caps.

At 12+ years, the risk of losses drops to zero, and 87% of investors earned over 10% annualized returns.

Key takeaway: Small caps have high return potential but demand the longest holding period to smooth out volatility.

Time > Market Timing

Many investors worry about entering the market at the right time.

But historical data shows that your starting point (whether the market is high or low) hardly impacts your final returns—if you stay invested long enough.