Is Indian Real Estate Still a Good Investment for NRIs Under New Tax Rules?

Do you have to pay more taxes if you sell your Indian Real Estate? Let's find out.

The Indian Budget 2024 introduced significant changes to the long-term capital gains (LTCG) taxation on the profits from the sale of real estate, impacting investors and homeowners. Today, we’ll decode its impact on NRIs.

Long-Term Capital Gains Taxation on Real Estate

In India, any profit from the sale of a property held for more than two years is classified as a long-term capital gain. The LTCG is taxed at a rate of 20% with the benefit of indexation, which adjusts the property's purchase price according to inflation, thereby reducing the taxable gains.

Budget 2024: Removal of Indexation Benefit

The recent 2024 budget proposed reducing the LTCG tax rate on real estate from 20% to 12.5% but with a major caveat: removing indexation benefits.

Indexation is an important tool that adjusts the purchase price of an asset for inflation, effectively reducing the taxable capital gains. The new rule has been viewed as a substantial setback for property owners, particularly those who have held their properties for many years.

Relaxations Announced Post-Budget

After the budget announcement, the finance minister, responding to pressure from various bodies and public outcry, provided partial relief by allowing property owners to choose between two options for the LTCG tax.

👉 Option 1: Pay a 12.5% LTCG tax without the benefit of indexation.

👉 Option 2: Pay a 20% LTCG tax with the benefit of indexation.

However, this relief was limited to properties acquired before July 23, 2024. The 12.5% LTCG tax without indexation will apply for properties acquired on or after this date.

The relaxation is available to individuals and Hindu Undivided Families (HUFs) with resident status under the Income Tax Act, 1961.

Does this mean non-resident individuals (NRIs) will not be eligible for indexation relief on properties acquired before July 23, 2024?

Unfortunately, Yes. NRIs cannot benefit from the new relaxation. However, Not Ordinarily Residents (NORs) are eligible to claim relief.

NORs are residents who were non-residents in nine out of the last ten financial years or have spent less than 730 days in India during the previous seven years.

Here’s how LTCG taxation under the new rules affects NRIs compared to resident Indians.

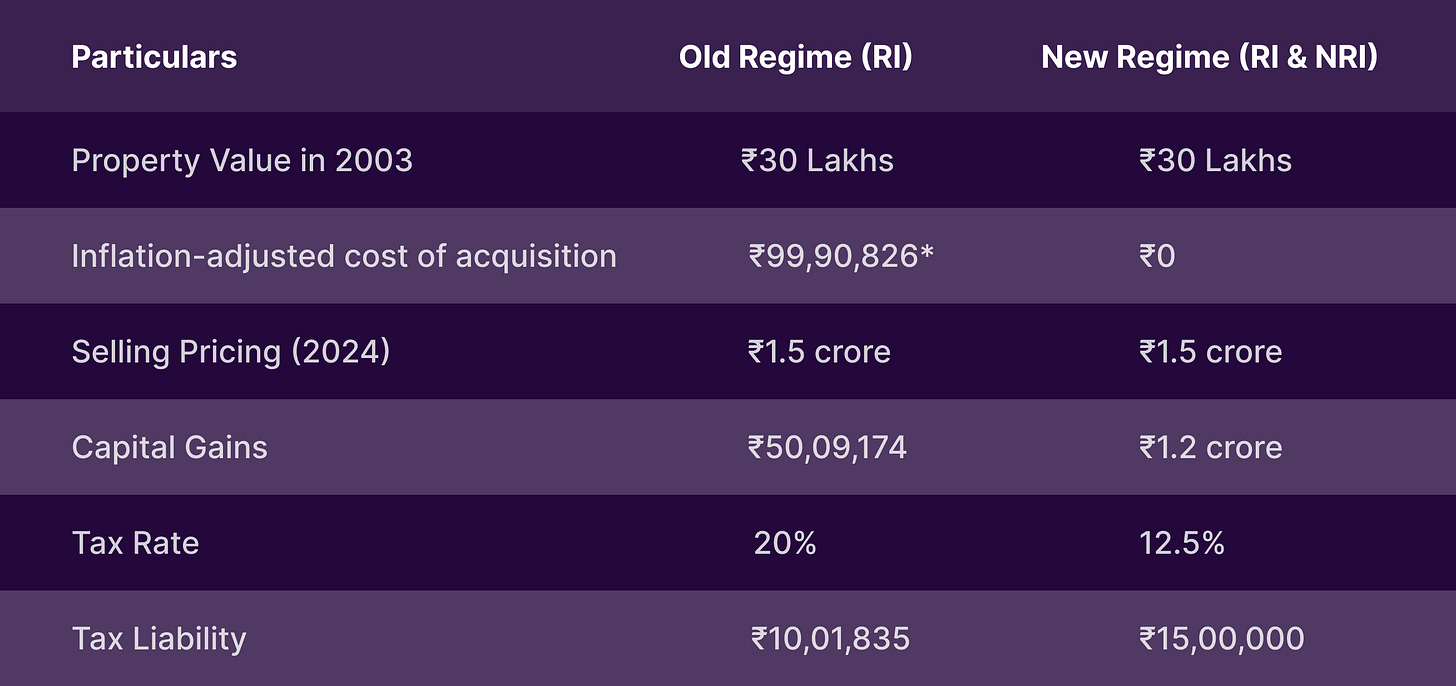

Property Bought in 2003 and Sold in 2024

In this scenario, resident Indians can opt for the old taxation and pay lower taxes, thanks to the indexation benefit. Meanwhile, NRIs must pay a higher tax on their capital gains mandatorily, per the new LTCG rules.

*Note: Cost Inflation Index (CII) = CII for the year the asset was transferred or sold / CII for the year the asset was acquired or bought

CII 2024 = 363, CII 2003 = 109

CII = 363/109 = 3.33027523

Inflation-adjusted cost of acquisition = 30,00,000 * 3.33027523 = ₹99,90,826

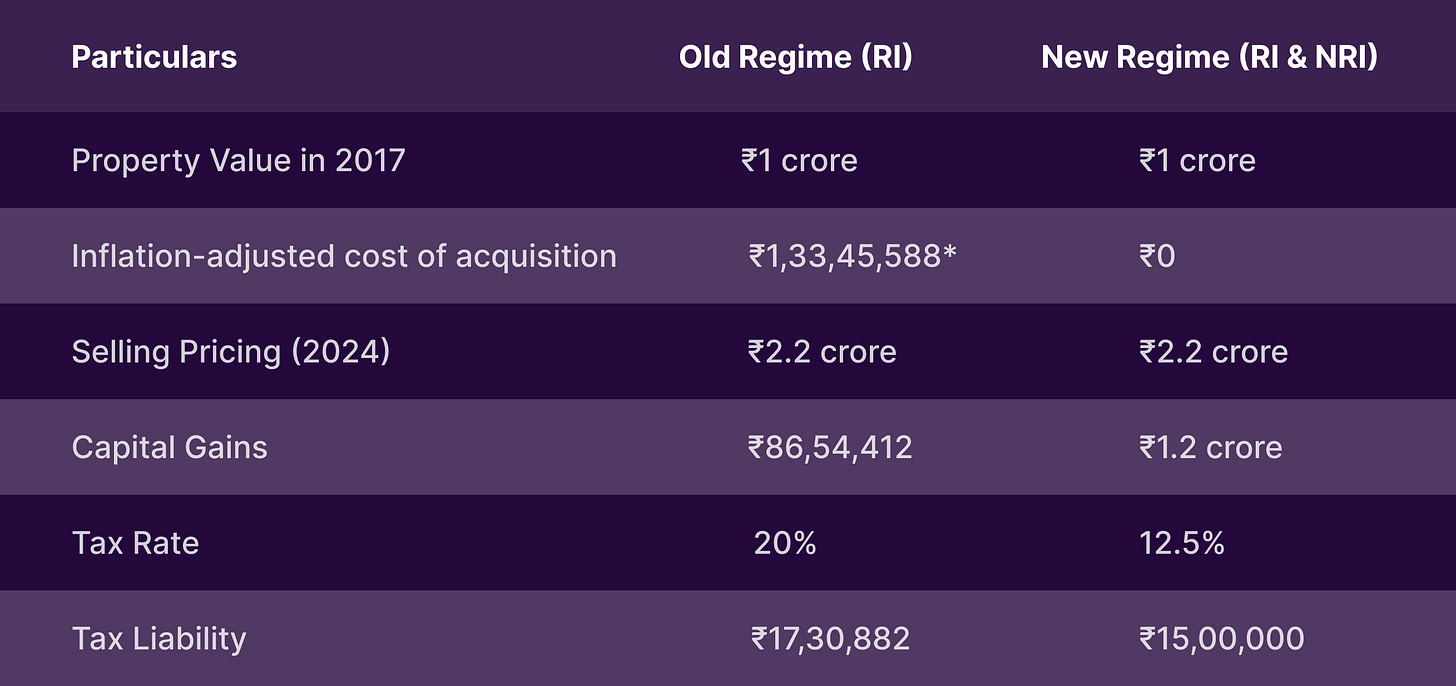

Property Bought in 2017 and Sold in 2024

*Note: CII 2024 = 363, CII 2017 = 272

CII = 363/272 = 1.33455882

Inflation-adjusted cost of acquisition = 1,00,00,000 * 1.33455882 = ₹1,33,45,588

Here, despite the indexation benefit, the tax liability is higher. On the other hand, NRIs pay lower taxes even without the indexation benefit. Why is that?

Recently purchased properties have a lower impact of inflation on their current price than properties bought 10, 20, or 30 years ago.

Are the recent tax changes and relaxations causing you concern? Would you still consider buying real estate in India? We'd love to hear your thoughts!

While buying real estate might still make sense for NRIs if you're looking to secure a property for family use or generate rental income.

However, mutual funds may be a better option than real estate if it is just for investing. Here is why -

Low Entry Cost

Liquidity

Potential for Higher Growth

Diversification

Professional Management

Easy Asset Management

Given these benefits, investing in Mutual Funds might be a smarter choice for NRIs living miles away from India.

Check out www.goinri.com if you want to start investing in Indian Mutual Funds as a NRI.

If you found this read helpful, feel free to forward it to your NRI friends and family who already own or planning to own real estate in India.