Investment Options for NRIs in India

Here's a list of top investment options for NRIs

Are you an NRI looking to invest back home in India?

Investing your hard-earned money in India can be a smart way to capitalize on the country's growing economy. However, with so many options available, deciding where to put your money can feel overwhelming. Whether you're seeking low-risk stability, high-reward opportunities, or a balanced approach, India offers a wide range of investment avenues tailored to your needs.

Why Should NRIs Consider Investing in India?

As an NRI, investing in India lets you tap into the country’s rapid growth, diversify your portfolio, and maintain flexibility in choosing your retirement location. However, the investment options, tax rules, and repatriation can be confusing. Here’s iNRI decoding these complexities for you

Low-Risk Investments: Stability and Security

If preserving your principal is a priority, these low-risk options offer modest returns while keeping your investment safe:

Fixed Deposits (FDs)

FDs provide a guaranteed interest rate for a fixed period, offering safety and predictable returns. NRIs can choose between NRE, NRO, and FCNR FDs.

Tip: Consider starting an FD with NRE or FCNR accounts to earn around 6% annual interest. Be cautious with NRO FDs due to lower returns and higher tax implications.

Debt Mutual Funds

These funds invest in government bonds, corporate bonds, and other fixed-income securities. They are designed to provide regular income and stability over the short to medium term.

Bonds

Bonds are debt instruments issued by governments or corporations, offering a fixed or variable interest rate (coupon). They pay out the principal at maturity, making them a reliable option.

Gold

Gold is a traditional investment that offers moderate risk and high liquidity. NRIs can invest in physical gold, ETFs, or digital gold, with the latter options being more secure and easier to manage.

Tip: NRIs currently are now allowed to invest in Sovereign Gold Bonds

High-Risk, High-Reward Investments

For NRIs seeking higher returns and are willing to accept more risk, consider these options:

Equity Mutual Funds

Managed by professionals, these funds offer diversified exposure to Indian markets. They’re ideal if you want to invest without being directly involved in stock picking.

Stock Investing

Direct equity investments involve purchasing shares of individual companies. While they offer the potential for high returns, thorough research is crucial to avoid potential losses.

Unit Linked Insurance Plans (ULIP)

ULIPs combine insurance with investment, offering life coverage and the opportunity to invest in various funds. However, NRIs should be cautious due to the high hidden charges often associated with these plans.

Balanced Investments: Risk and Reward in Harmony

If you’re looking for a middle ground between stability and growth, these options might be right for you:

Real Estate

Investing in property can provide rental income and long-term capital appreciation. However, it requires active management and a deep understanding of local markets.

National Pension Scheme (NPS)

A long-term retirement savings plan offering tax benefits and market-linked returns. NRIs aged 18-60 can invest in NPS, making it a solid option for those planning for the future.

Quick Tips for NRI Investors

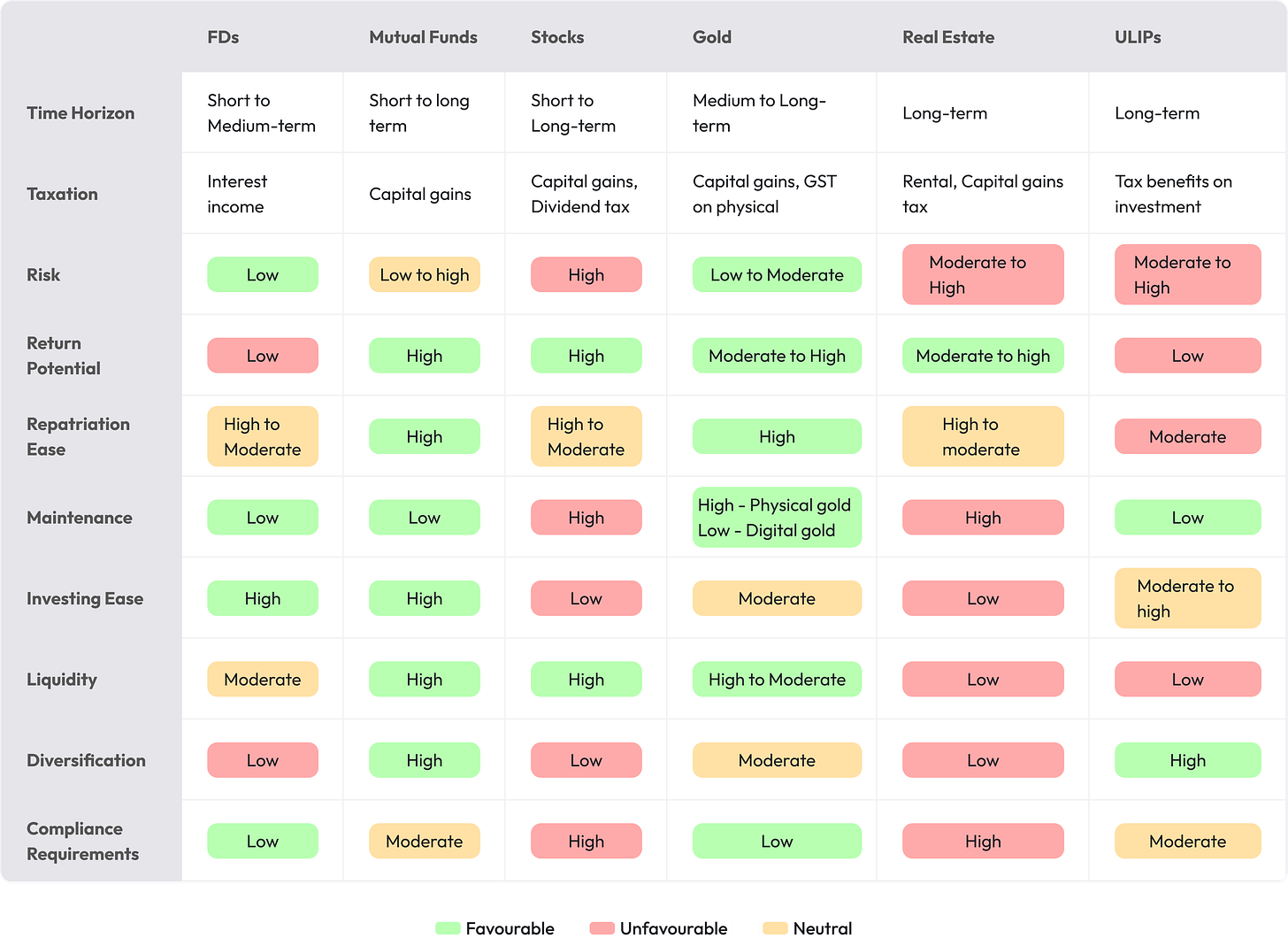

Time Horizon: Determine whether you’re investing for the short-term or long-term.

Tax Implications: Be aware of tax rules both in India and your country of residence.

Ease of Repatriation: Choose investments that allow easy transfer of funds back to your country.

Maintenance Effort: Some investments require active management, while others are more passive.

Ease of Investing: Consider the accessibility, paperwork, and digital platforms

Conclusion

Among the options, mutual funds emerge as an easy and effective way to ride the Indian markets. They offer a balance of risk, return, and convenience without requiring extensive market knowledge.

At iNRI, we’ve simplified the process even further. Our completely digital solution makes investing in Indian mutual funds a breeze. Plus, we offer a host of additional services like cross-border taxation, NRE/NRO account opening assistance, and compliance services, ensuring a smooth and hassle-free investment experience.