iNRI’s Smart Investing Tool: For Your DIY MF Investments

iNRI’s Smart Investing has got a new look, check out the new product features.

Introducing our latest Smart Investing Tool —an intuitive and personalized experience for investing in Indian mutual funds.

Guess what? 40% of iNRI’s customers have already used this tool to craft their smart portfolios. And now, it’s gotten even smarter! 🎯

What Is iNRI’s Smart Investing Tool?

Investing in mutual funds can be both exciting and overwhelming. But what if you had a smart tool that could tailor your investments to your unique preferences and financial goals?

That’s exactly what iNRI’s Smart Investing Tool does with its latest integration of machine learning. The Smart Investing Tool has become a more powerful and precise companion for your investment journey.

The new tool simplifies decision-making by analyzing your risk tolerance (risk score) and investment preferences. It offers fund recommendations tailored to your unique needs, making mutual fund investing more easy than ever.

Features of iNRI’s Smart Investing Tool

iNRI’s Smart Investing Tool comes loaded with features designed to make investing a more informed and customized experience:

1. Risk Assessment for Tailored Investments

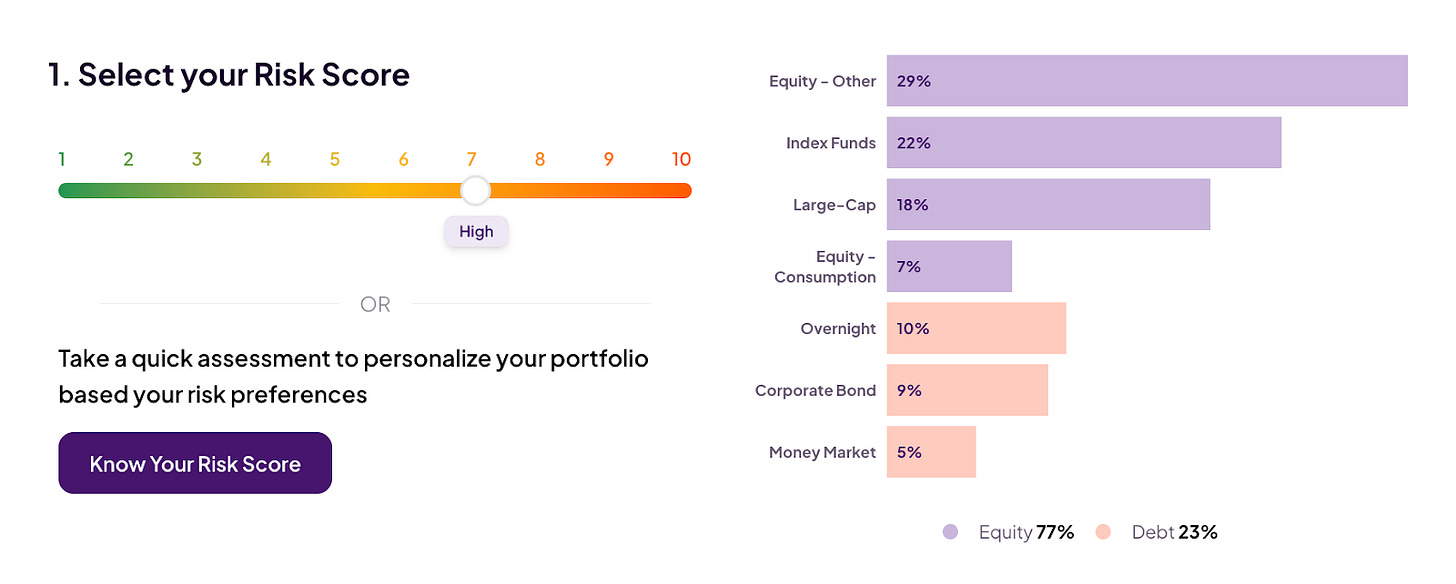

The risk score system ensures that every portfolio is aligned with your risk tolerance. Whether you want to be aggressive or conservative, the tool curates the fund recommendations to suit your personal risk appetite.

2. Investment Plan Customization

The tool takes into account how you want to invest—whether through lumpsum, monthly, or quarterly SIPs. It also factors in your investment horizon, allowing for more accurate return estimations based on historical performance and future market trends.

3. Flexible Smart Portfolios

Typically consisting of 5 to 7 diversified mutual funds, your smart portfolio is highly flexible. Not only can you swap out funds, but you can also adjust asset allocations or even shuffle the entire portfolio. The goal is to empower you with choice and control, without compromising on the intelligence behind the recommendations.

4. Machine Learning-Driven Recommendations

With the recent integration of machine learning, the tool is now better equipped to provide precise recommendations. It can analyze a vast dataset of market trends, fund performances, and your unique preferences to offer optimized portfolio suggestions, helping you stay ahead of the curve.

What Is the Risk Score?

One of your key inputs to iNRI’s Smart Investing Tool is your Risk Score—an essential parameter that is used by the tool to personalize the mutual fund recommendations for you.

Risk tolerance helps determine the right mix of assets for your portfolio. Whether you’re a high-risk taker looking for aggressive growth or someone who prefers a more conservative approach, knowing your risk level allows you to invest with clarity and confidence. If you don’t happen to know your risk score, we will help you find your risk score by answering 5 simple questions.

Understanding how comfortable you are with the stock market's ups and downs is called ‘risk tolerance’.

Example:

A higher risk level (7-10) means you're hoping to grow your savings more aggressively – and are comfortable with volatility. A lower risk level (1-4) means you're looking for stability and might invest in lower-risk funds.

We Have Introduced iNRI Mutual Fund Rating

The strength of iNRI’s Smart Investing Tool lies in its intelligent mutual fund ranking. Using advanced machine learning algorithms, we assess multiple critical factors:

Historical Performance: Consistency of returns over time.

Fund Size: Total assets under management, reflecting the fund’s stability and influence.

Inception Returns: Tracks the fund’s total returns since its launch.

Expense Ratio: Lower expenses often indicate cost-effective management, enhancing your returns.

Fund Manager Performance: Evaluates the expertise and track record of the fund’s managers.

By combining these insights with your unique preferences and risk tolerance, iNRI’s tool ranks and recommends the best funds for your portfolio. This makes the selection process for you very simple!

Start building your Smart Portfolio with iNRI today!