Impact of the Indian Budget’24 for NRIs and OCIs

A quick read highlighting key points for NRIs.

The past week has all been about pre-budget predictions and post-budget analysis.

Modi Government 3.0 proposed their budget on July 23, 2024 - was it good? How does it impact NRIs? Let’s find out.

Budget 2024: Key Highlights

"The theme of Budget 2024-25 is EMPLOYMENT.

E for Employment and Education

M for MSMEs

P for Productivity

L for Land

O for Opportunity

Y for Youth

M for Middle Class

E for Energy Security

N for New Generation Reforms, and

T for Technology." Sitharaman said.

Key Highlights

Fiscal Deficit has been budgeted at 4.9% v/s interim budget of 5.1%.

Inflation at 5.4%, at par with the central bank's predictions

Higher Capital gains taxes on financial assets

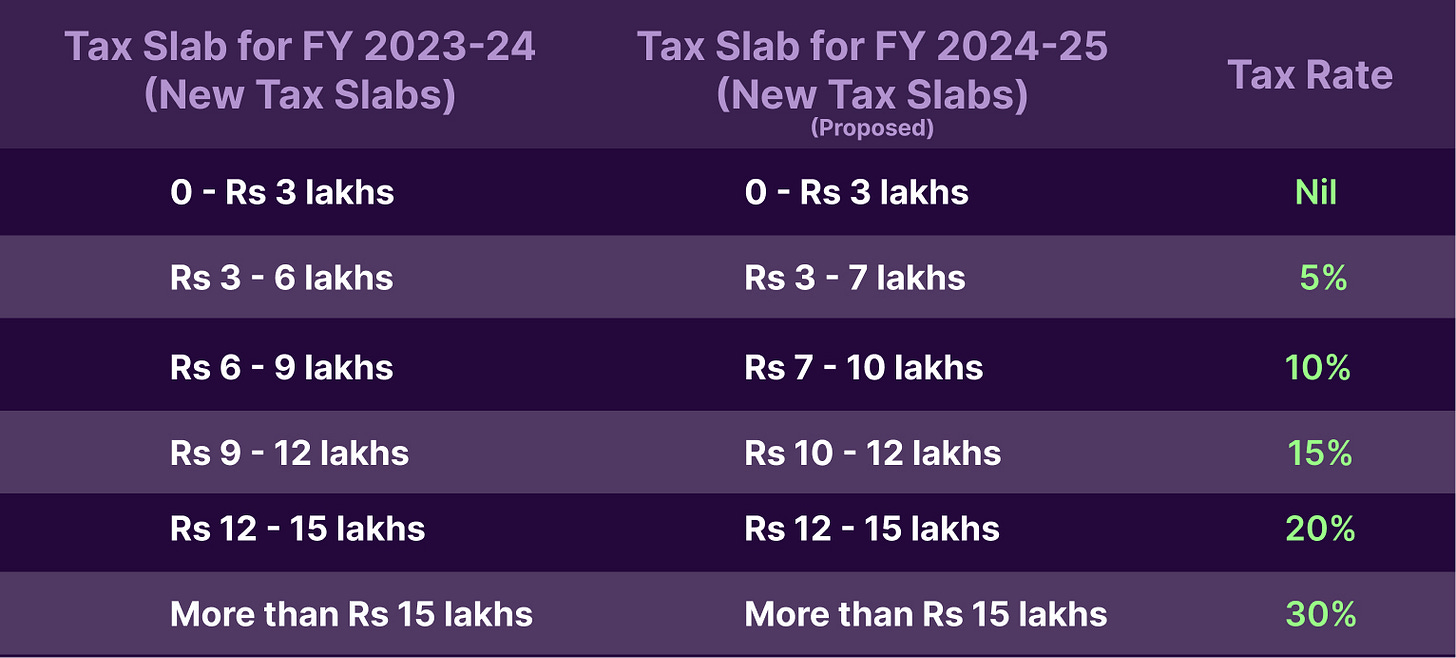

New slab rates under New Tax Regime

Higher Standard deduction at Rs 75,000 Vs Rs 50,000

(collectively (4&5), save up to ₹17,500 in total tax outgo if in the 30% tax bracket)

Now, getting down to business…

How Does The Budget Impact NRIs?

✅ The Good Part

👉 Lower long term capital gains on real estate

Flat 12.5% tax rate for all types of long-term capital gains, regardless of the asset class. For real estate, it reduced from 20% to 12.5%.

👉 Higher tax-free limit for long-term capital gains

The exemption limit increased from Rs. 1 lakh to Rs. 1.25 lakh for equity-related investments.

(the above two revisions motivate the equity investors to stay invested for the long term)

👉 Simplified holding periods

Long-term, if held for more than 12 months - Listed securities, like - shares, including units of listed business trusts.

Long-term, if held for more than 24 months - Unlisted shares, immovable property, bonds, debentures, and gold.

👉 Revised tax slabs under new tax regime

Increased the income thresholds and lowered tax rates.

🌟 No changes to the old tax regime slab rates.

👉 Additional deductions for National Pension System (NPS) contributions

Under Section 80CCD(1B), NRIs can now claim an additional deduction of Rs 50,000.

❌ The Not So Good Part

👉 No Indexation benefit for all assets

The indexation benefit for adjusting the purchase price of an asset for inflation has been removed for all assets - gold and real estate. Now, LTCG are taxed at flat 12.5%.

👉 Increased tax rate on short term capital gains

The short-term Capital Gains Tax (STCG) is now 20% vs. 15%. STCG applies to assets like stocks, equity mutual funds, and business trust units (holding period < 12 months).

👉 Higher Tax Deducted at Source (TDS) for real estate

1% TDS will be applicable on selling an immovable property valued at more than Rs 50 lakh, even if multiple buyers and sellers are involved in the transaction.

Overall, the Budget has pros and cons, but it undeniably aligns with India's long-term vision of Viksit Bharat 2047 (a developed India).

What did you think of the budget this year? Let us know.

Until next week!