How To Invest Your Inheritance Wisely?

Unlock smart strategies to grow and manage inherited wealth.

If you’ve recently inherited money, Congratulations — this is a great opportunity to strengthen your financial future! However, growing that wealth requires more than just a good bank account. Whether it’s property, cash, or investments, managing an inheritance wisely can lead to long-term benefits.

Inheritance can be a blessing, but it also brings the responsibility of managing and growing the money wisely. For Non-Resident Indians (NRIs), this task can feel especially complex given the unique challenges of investing from abroad. In this newsletter, we’ll explore how you can wisely invest the inherited wealth without losing sight of your financial goals.

Investment Strategies for Inherited Money

1. The “Safe” Route: Fixed Deposits (FDs)

It’s common for many to turn to FDs as a “safe” investment. They appear risk-free and promise to preserve capital. But here’s the catch: real returns are often zero or even negative after accounting for inflation. While your money might stay intact nominally, its actual purchasing power erodes over time.

💡 Verdict: FDs may be secure, but they’re far from ideal for wealth growth.

2. Real Estate Investments

Another popular choice among NRIs is real estate. It feels tangible and is often seen as a long-term store of value. However, real estate comes with its own set of challenges:

High maintenance and management requirements.

Legal and documentation hurdles.

Risk of unauthorized occupancy or disputes.

Low rental yields and stagnant appreciation in many regions.

💡 Verdict: Real estate might work for those with the bandwidth to manage it actively, but the returns are not as high or reliable as many assume.

3. Equity Markets

Investing in the markets - stocks or mutual funds, offer significantly better growth opportunities. However, for NRIs, direct stock investment can be daunting due to:

The need for active monitoring and trading during market hours.

Regulatory hurdles and tax implications.

This is where mutual funds shine as an excellent alternative. Professionally managed by fund managers, mutual funds offer:

A hands-off approach for investors.

Diversified portfolios that spread risk.

Options catering to different risk appetites and investment goals.

Why Mutual Funds Are Ideal for NRIs

Not everyone is comfortable taking high risks with inherited money, and that’s where mutual funds offer flexibility. You can choose from various fund categories based on your objectives. There are funds that invest across both Equity and Debt. The equity portion helps with growth, while the debt portion ensures stability.

Aggressive hybrid funds can be perfect for long-term goals, offering higher equity exposure and competitive returns.

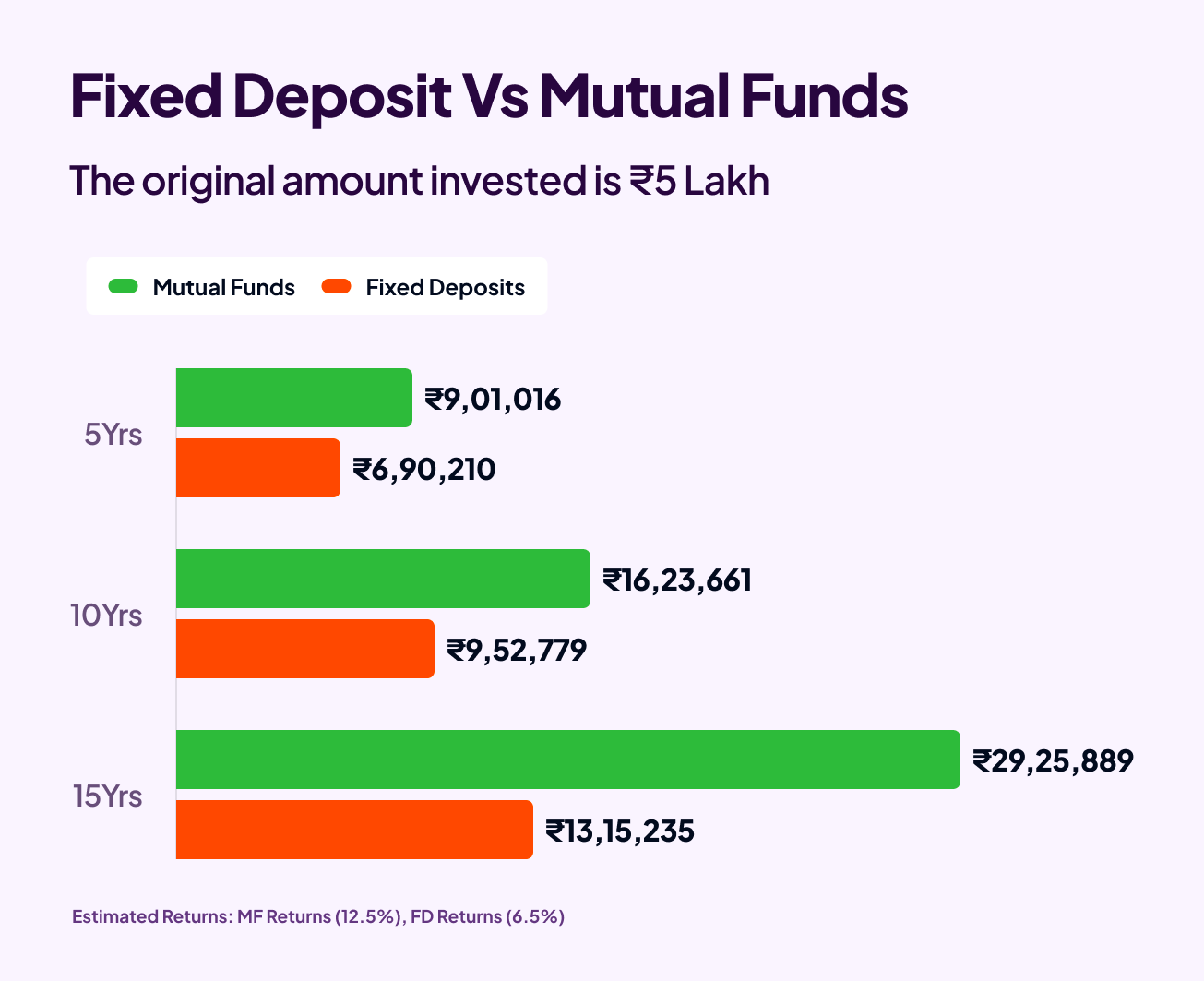

Here’s a quick comparison between FDs and MFs

You might be thinking, "But isn’t the stock market risky?"

Yes, it does come with risks. However, time is a powerful equalizer. Over periods of 10, 15, or 20 years, the market's natural fluctuations tend to stabilize, significantly reducing the likelihood of losses.

Historical data consistently shows that the longer you remain invested, the smaller the chance of negative returns. In fact, extended investment horizons not only protect against losses but also increase the probability of achieving double-digit growth.

Take a look at the table below to see how time reduces risk and enhances potential returns!

What Should You Do?

Diversify with Mutual Funds: Opt for mutual funds that balance risk and return. iNRI’s Smart Investing Tool will help you generate a personalized investment portfolio based on your risk profile and investment preferences.

Stagger Your Investments: Choose a Systematic Investment Plan (SIP) or a Systematic Transfer Plan (STP) instead of investing all your money at once. In these plans, you invest your inherited corpus across funds over a period of 6 months to 1 year. These strategies help spread out your investments over time, reducing the impact of market volatility.

Annual Portfolio Reviews: Regularly review your portfolio—ideally, once a year—to ensure it remains aligned with your financial goals and risk tolerance. Adjustments may be necessary to stay on track with your plans.

This can get overwhelming. Invest through iNRI, where experts take care of your annual portfolio reviews.