Gold and Silver: The Comeback Assets in Uncertain Times

In India, gold has always held an emotional and cultural significance. From weddings to festivals, it’s woven into our lives as a symbol of prosperity and security. Yet, beyond its sentimental value, gold, and now increasingly - silver, play a crucial financial role in today’s investment landscape.

Over the past year, global markets have been navigating through a perfect storm: inflationary pressures, rising interest rates, slowing growth, and geopolitical tensions. In times like these, investors often look for safety nets - assets that can protect their wealth when equity markets become volatile or uncertain. That’s where gold and silver come into the picture, not just as traditional assets but as modern portfolio stabilizers.

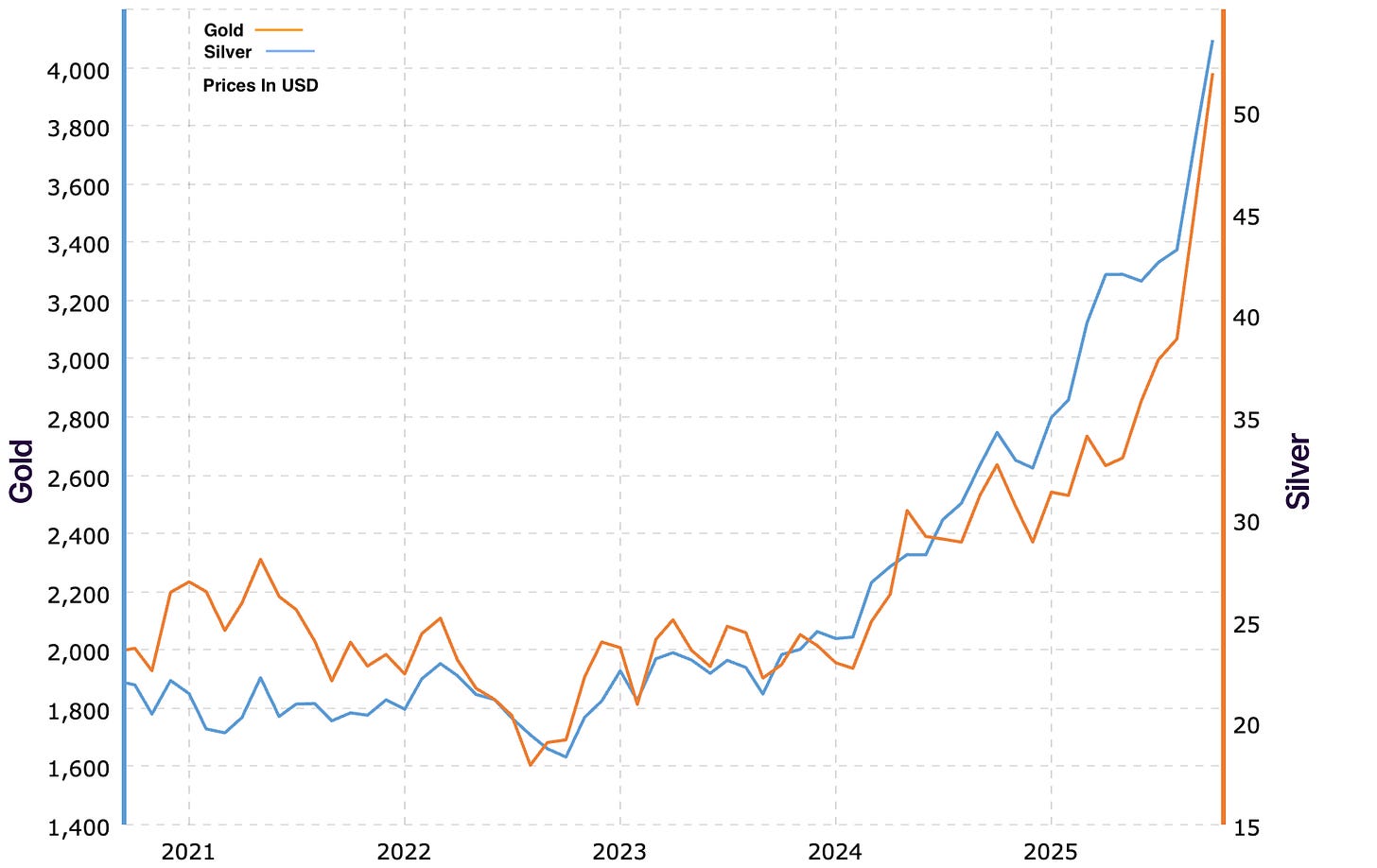

In the last 5 years...

From 2020 to 2025, both gold and silver prices showed strong upward trends, with a sharp surge starting in 2024. Gold nearly doubled to around $4,000/oz, while silver more than tripled to over $50/oz, reflecting heightened demand and global economic uncertainty.

Why Gold Still Shines Bright?

Gold has always been regarded as a “safe haven” asset. Historically, it tends to perform well during periods of economic distress or high inflation. Unlike paper currencies, gold is a real, tangible asset that doesn’t rely on the creditworthiness of any government or institution.

In the last few years, inflation has remained sticky across many major economies. Central banks, including India’s RBI, have responded with interest rate hikes - but inflation hasn’t entirely cooled off. Meanwhile, equity markets have seen sharp swings due to global uncertainty.

Gold has quietly done what it does best - preserve purchasing power. Its price has steadily risen, giving investors not just stability but also positive real returns when adjusted for inflation.

Another often-overlooked point: central banks across the world, including India’s, have been increasing their gold reserves. That’s a clear signal of confidence in gold’s enduring value as a hedge against currency risk and economic instability.

Silver: The Dual Advantage Metal

While gold steals the spotlight, silver has been catching up fast - and for good reason. Silver is not just a precious metal; it’s also an industrial metal. It’s used in electronics, solar panels, batteries, and electric vehicles - sectors expected to grow exponentially in the coming decade.

This gives silver a unique dual advantage. It benefits from the same “safe-haven” demand as gold during uncertain times, but it also participates in the industrial growth story. When economies recover, silver often sees sharper price rallies than gold due to industrial demand.

Over the long term, silver’s volatility can be higher, but so can its potential returns. For investors who want to balance safety with growth, silver offers an intriguing middle ground.

Gold and Silver Funds: The Smarter Way to Invest

While owning physical gold or silver has emotional appeal, it also comes with challenges—storage, purity concerns, and liquidity issues. For modern investors, Gold and Silver Funds (or ETFs) offer a far more convenient and transparent way to gain exposure to these metals.

The Current Macro Case for Precious Metals

The ongoing macro environment further strengthens the case for precious metals. The global economy faces a tricky combination: high debt levels, moderate growth, persistent inflationary risks, and geopolitical tensions in multiple regions are conditions under which precious metals typically thrive.

In the era of crypto, AI-driven stocks, and high-growth bets, gold and silver might seem old-fashioned. But smart investing isn’t about chasing trends - it’s about building a portfolio that can withstand all seasons. Precious metals bring that balance.

They don’t promise quick returns, but they promise resilience. When equities stumble, they hold ground. When inflation eats into fixed income, they protect purchasing power.

As investors, the goal isn’t just to grow wealth, it’s to sustain it. And few assets have stood the test of time like gold and silver.

So, if you haven’t revisited your asset allocation lately, now might be the right time. Consider adding Gold or Silver Funds to your portfolio—they’re not just metals; they’re a hedge, a diversifier, and a quiet pillar of financial strength.