Does Trump Presidency Impact Indian Markets?

How will Trump’s win effect Indian markets?

Donald Trump returned victorious to the White House after a fierce battle with the Democratic nominee, Kamala Harris, winning 295 electoral votes. The Indian stock market, battling with Foreign Institutional Investors (FII) outflows, poor Q2 results, and high valuation, cheered his win by surging by almost 0.6% on the day of the result. However, that didn't last long, and the stock market fell by over 1% the next day. So, let's find out how the Indian stock market will react in the Trump era.

Opportunities and Challenges for the Indian Economy

Trump's campaign emphasizes an "America First" approach, aiming to boost American businesses through higher import tariffs, increased employment, and lower corporate taxes. This could benefit India, as US companies may adopt a 'China plus One' strategy, positively impacting the Indian economy. However, high tariffs might hurt Indian exports, and a strong dollar could lead to capital outflows and inflation in India. While these effects are long-term, immediate impacts are visible in the stock market.

Indian Stock Market Reactions to US Elections

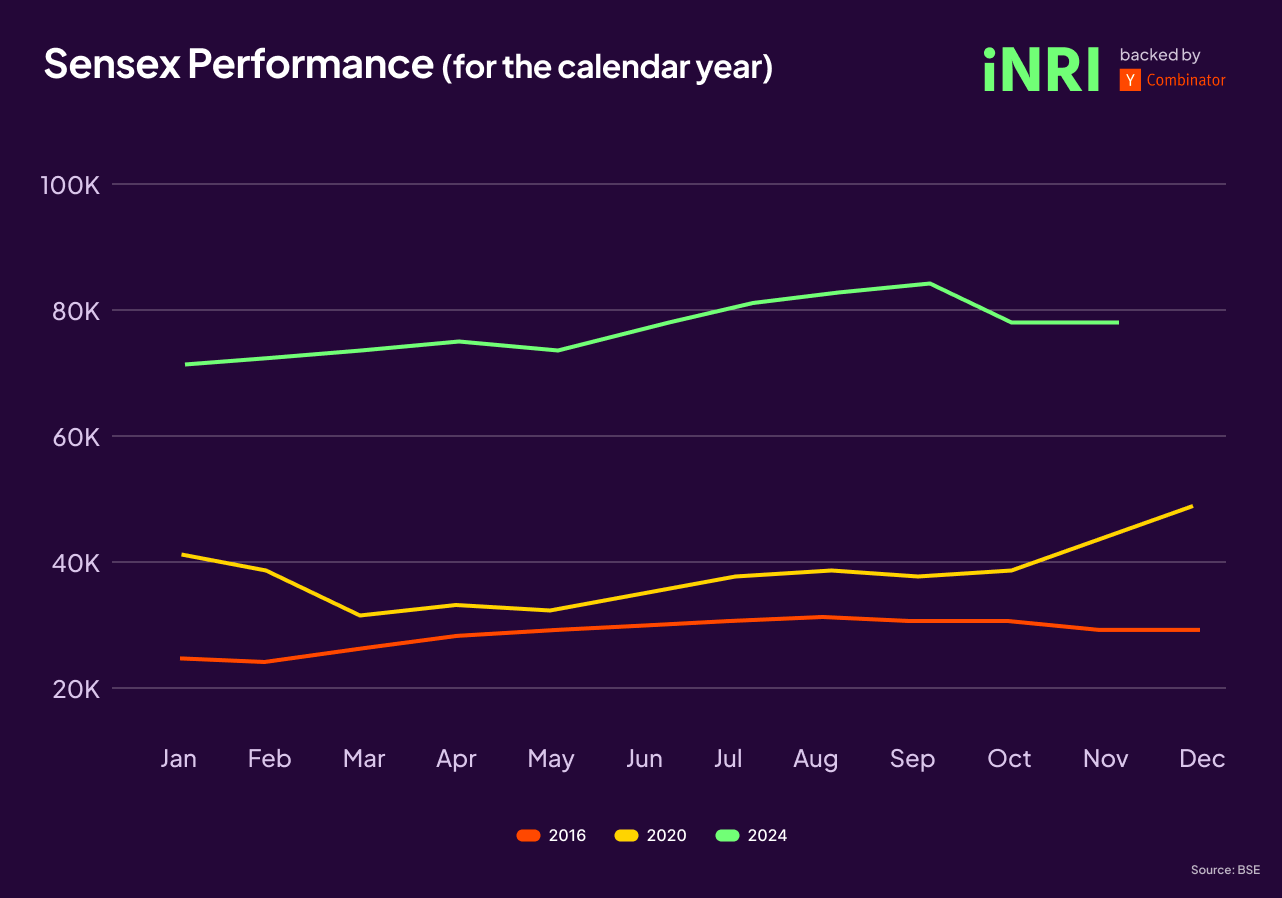

Stock markets tend to exhibit historical patterns, and similar events can lead to comparable market movements. Following Trump’s second presidential win, let’s examine past market behaviours and potential reactions.

In 2016,

Before the elections, there was a lot of speculation about Hillary Clinton winning the US Presidential elections. Hence the markets were on an uptrend up until the election. However, after the election results, the markets fell after Trump's historic win. However, this is not the only reason why markets fell. Narendra Modi announced demonetization and replacement of Rs 500 with new notes, leading to panic among investors and a fall in markets.

In 2020,

The US elections were conducted during the middle of the pandemic. The Indian markets, which were already at all-time highs, reacted positively to Joe Biden's win against Trump. In addition, the RBI also cut interest rates, and the government announced stimulus packages and launched the Product Linked Incentive (PLI) scheme, which further fuelled market growth.

In 2024,

The markets fell drastically until the US elections due to poor Q2 results and high valuations. However, after Trump's win, the markets grew slightly, but only to fall the next day. With Indian markets battling with its own issues, Trump's win couldn't stop the bears. Only time can tell how the markets will span out in the next month.

Conclusion

Although the US elections impact the Indian markets in the short term, their effect in the long term is minimal. Economic growth, global economic conditions, fiscal and monetary policy, and geopolitical stability determine its long-term trend. Hence, one must be wary before basing one's decisions on these short-term and short-lived events and concentrate on building wealth in the long run.

India is one of the fastest-growing economies in the world, and the government is taking all measures to boost this growth further. If you look at the historical patterns, despite how the US elections have spanned out, the Indian markets have grown in the long run, multiplying investors' money. With a strong foundation and a promising future, investing in India remains a compelling opportunity for those looking to secure their financial future. Embracing a long-term perspective can help investors navigate short-term volatility and reap substantial rewards.