Demystifying Mutual Fund Taxation for NRIs

Here’s How Your Mutual Funds Will Be Taxed

Investing in mutual funds has been a popular choice for Non-Resident Indians (NRIs) worldwide. It's one of the easiest ways to diversify globally and get access to the Indian markets. However, taxation on mutual funds can seem complex due to the varying rates based on the type of fund, duration of investment, and applicable treaties. This newsletter provides a concise guide to help you understand how mutual funds are taxed for NRIs in India.

Types of Mutual Funds and Taxation Basics

Mutual funds in India are broadly classified into equity-oriented funds and debt-oriented funds, each having distinct tax implications for NRIs.

Equity-Oriented Funds: These funds invest at least 65% of their portfolio in equities or equity-related instruments.

Debt-Oriented Funds: These funds invest in fixed-income securities like bonds and government securities, with less than 65% exposure to equities.

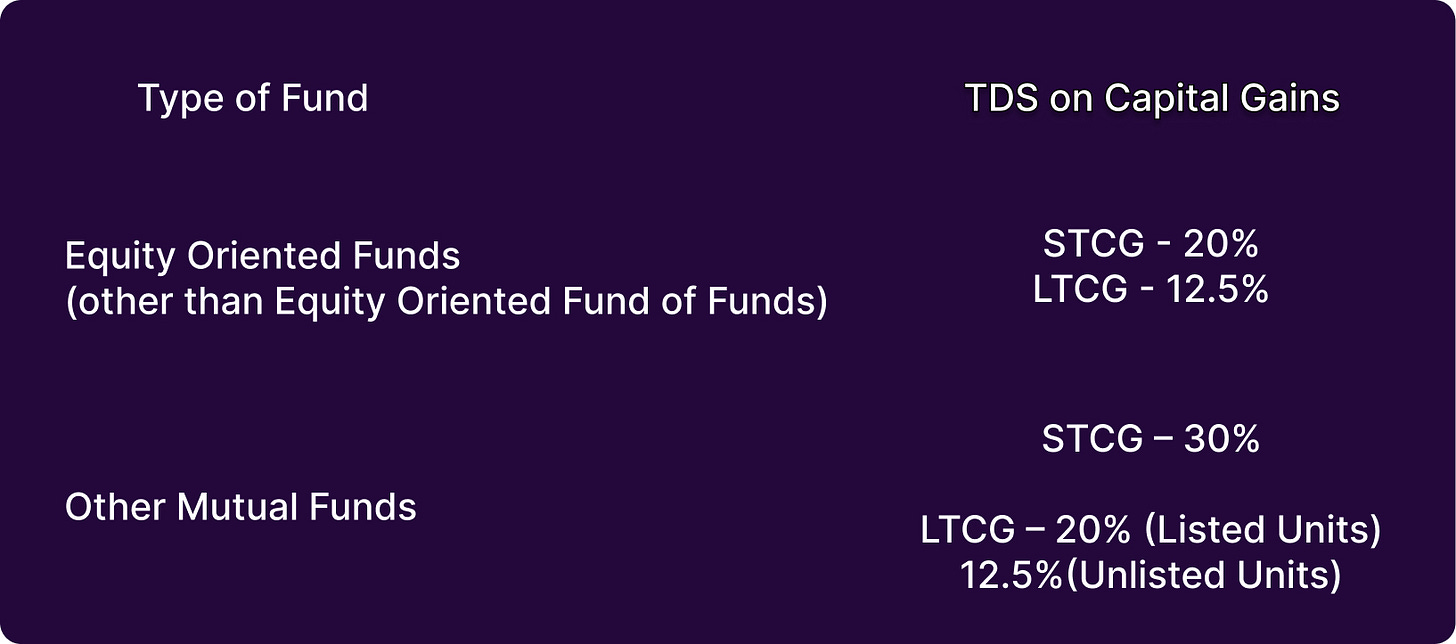

NRIs are subject to Tax Deducted at Source (TDS) on capital gains and dividend income from these mutual funds. The rates vary based on the type of fund and holding period, as discussed below.

Taxation of Capital Gains

Capital gains tax depends on the holding period of the investment and the type of fund.

Holding Period Classification

Short-Term Capital Gains (STCG):

Equity Funds: Holding period of less than 12 months.

Debt Funds: Holding period of less than 36 months.

Long-Term Capital Gains (LTCG):

Equity Funds: Holding period of 12 months or more.

Debt Funds: Holding period of 36 months or more.

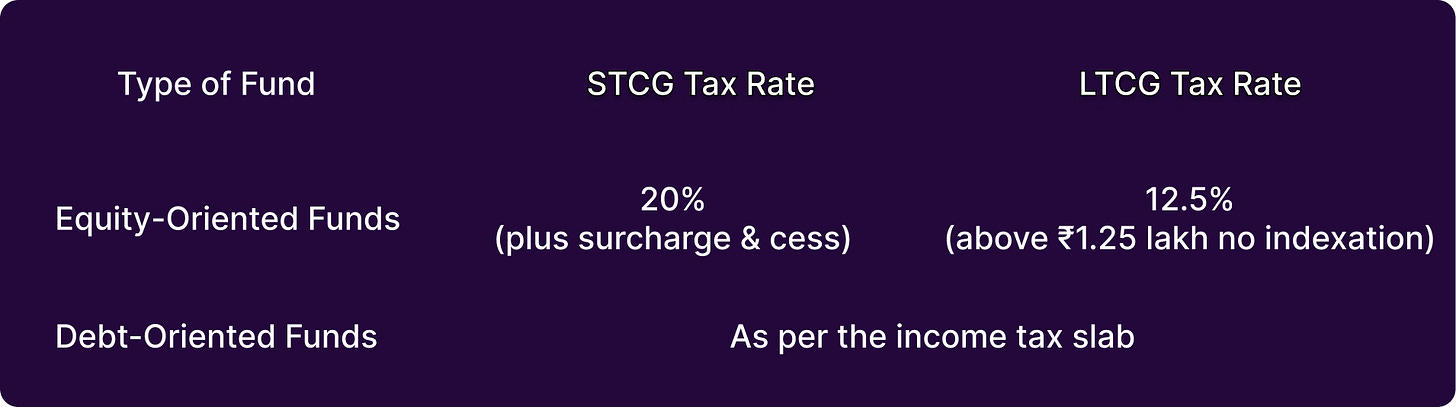

Note: From July 23, 2024, capital gains from debt mutual funds is taxable as per the investor’s applicable Income Tax slab rate.

Tax Rates on Capital Gains

Tax Deducted at Source (TDS)

Taxation on Dividends

Dividends from mutual funds are taxable in the hands of NRIs as per their applicable income tax slab. However, fund houses deduct TDS at 20% (plus applicable surcharge and cess) before distributing the dividend.

Special Considerations for NRIs

Double Taxation Avoidance Agreement (DTAA):

NRIs investing in India may benefit from a lower tax rate under a DTAA between India and their country of residence. To avail of these benefits, you must provide a valid Tax Residency Certificate (TRC) to the fund house.Repatriation of Funds:

Mutual fund redemptions can be repatriated without any restrictions to your overseas bank account, provided the initial investment was made using NRE (Non-Resident External).Compliance Requirements:

NRIs need to provide a valid PAN and complete the KYC process for mutual fund investments.

A declaration of FATCA (Foreign Account Tax Compliance Act) compliance is mandatory.

Avoid Tax Complexity: Hire a Tax Expert

Understanding mutual fund taxation as an NRI can be intricate due to varying tax rules and compliance requirements. Hiring a professional can save you time and ensure compliance with Indian tax laws.

At iNRI’s Tax Marketplace, you can connect with experienced tax experts who specialize in NRI taxation. They can help you navigate taxation on mutual funds, claim DTAA benefits, and simplify the repatriation process.