🧾 Capital Gains Taxation for NRIs

Here’s what you must know before you invest or exit

If you're an NRI investing in Indian assets—be it real estate, mutual funds, or stocks—capital gains tax is something you cannot afford to ignore. The rules differ from resident taxation, and NRIs are subject to TDS (Tax Deducted at Source) at the time of sale. But with smart planning, indexation benefits and Section 54 exemptions can help reduce your tax burden significantly.

Let’s break it down for you.

📊 What Are Capital Gains?

When you sell a capital asset like property, mutual funds, or shares and earn a profit, it’s called a capital gain.

Capital gains are classified based on how long you’ve held the asset:

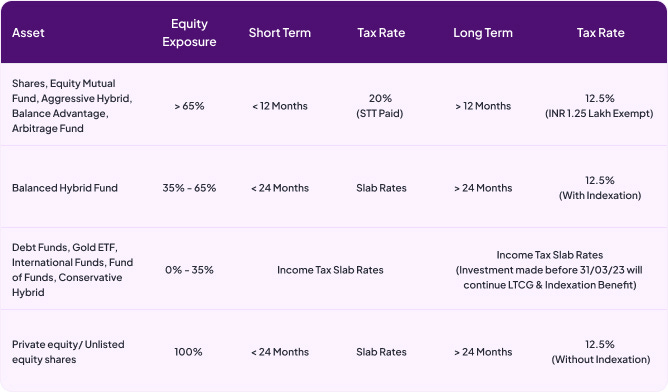

📌 Holding Period & Tax Rate Overview

Shares and Mutual Funds: Gains from the sale of shares and mutual funds are subject to short-term or long-term capital gains tax.

Immovable Property: Profits from the sale of property are subject to capital gains tax, with exemptions available under certain conditions.

💸 TDS Rules for NRIs (You Can’t Skip This)

Unlike residents, NRIs face TDS deduction right at the time of sale—even if there’s a capital loss!

Under Section 195 of the Income Tax Act, TDS must be deducted on certain payments to non-residents, such as salary, interest, rental income, capital gains and dividend income.

It ensures tax is collected before making payments to non-residents.

TDS ranges between 10% to 30%.

Important: Even if the actual tax payable is lower (after exemptions or losses), TDS is still deducted. You can claim refunds by filing your India tax return.

🏡 Section 54: Save Tax on Property Gains

If you’re an NRI selling a residential property, you can reinvest in another property or specified bonds and save on LTCG tax. Here's how:

📌 Section 54 & 54F – Quick Guide

Note: The reinvestment must be in India, and only one residential property is allowed for the exemption.

📤 Filing Returns as an NRI: Still Important

Even if TDS was deducted, filing a return in India can help you:

Claim a refund (if TDS > actual tax liability)

Carry forward capital losses to offset future gains

Use DTAA to avoid double taxation

✨ Pro Tips for NRIs to Optimize Capital Gains Tax

✔️ Plan your exit based on holding period—timing can move you from STCG to LTCG

✔️ Explore Section 54EC bonds if you don’t want to reinvest in real estate

✔️ File returns even if TDS is deducted to claim refunds or carry forward losses

✔️ Consider DTAA and Form 67 to offset taxes paid abroad

File Taxes Through iNRI

Sign up today and take the help of expert CAs who specialise in NRI taxation. A completely digital and hassle-free solution.

Sign Up - https://app.goinri.com/india-tax-filing

Got any questions? Speak to our Virtual Tax Consultant, Neil.

Talk to Neil - https://app.goinri.com/india-tax-filing#virtual-ca