Are Japanese Housewives Driving the Global Stock Market Dip?

Is the current market dip indicating recession?

After hitting all-time highs—25K for Nifty and 82K for Sensex—the Indian markets took a sudden 3.2% drop in just one day. But this dip wasn’t just in India; it was global. Some experts point to Japan’s recent interest rate hike to 0.25% as a key factor.

To understand why this matters, let’s rewind a bit and talk about the Yen Carry Trade. For years, Japan had negative interest rates, meaning you could borrow money almost for free. Imagine borrowing $1,000 and only needing to pay back $980 with no interest!

Thousands of Japanese housewives, affectionately called “Mrs. Watanabe,” took advantage of this by borrowing at zero interest and investing in other countries where they could earn much higher returns, like 5% to 20%. Eventually, even big corporations joined in, and the Yen Carry Trade became a money-making machine for years.

But then, in March 2024, things started to change. Japan raised interest rates for the first time in 17 years to 0.1%, and by July 31st, they bumped it up again to 0.25%. This move also caused the Yen to strengthen against the dollar, hitting a seven-month high.

With these shifts, Japanese traders found it harder to keep the Yen Carry Trade going, so they started selling their foreign stocks to convert the proceeds back into Yen and pay off their loans.

However, this isn’t the whole story. Higher unemployment rates reported in the latest U.S Labor market report and rising geopolitical tensions in the middle-east also contributed to the global market dip.

But don’t worry, the market moves in cycles

Market cycles are recurring patterns seen in stocks, corporate profits, and the economy. They typically follow this rhythm: a few years of strong growth → a peak → a downturn that shakes things up → and then the cycle starts all over again. Let’s see how cycles work so you'll be prepared for whatever comes your way.

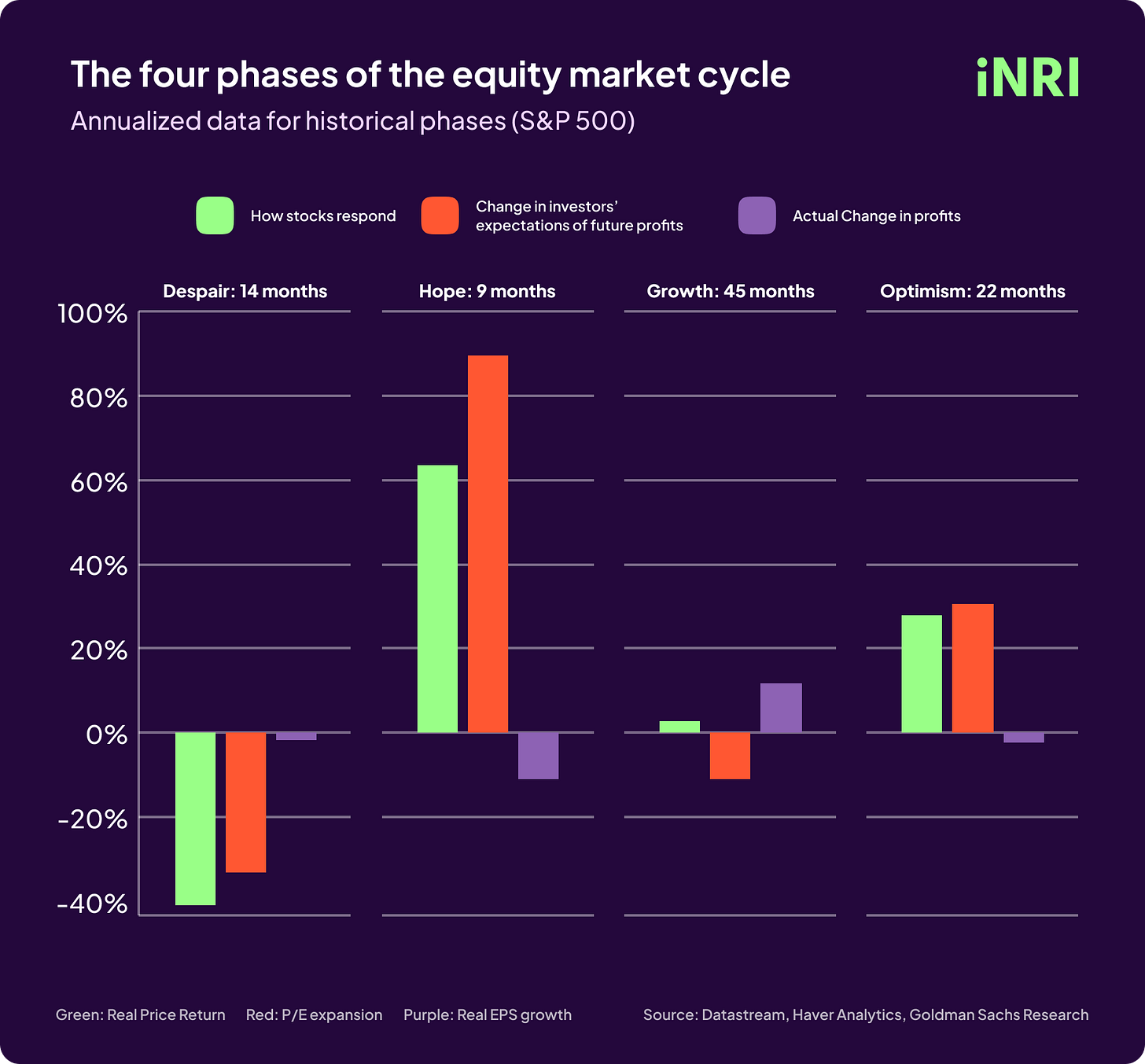

An equity market cycle has 4 phases & a complete cycle spans six to seven years.

Despair (new cycle): Expecting a recession, investors sell off their assets.

Hope (early cycle): Some investors start buying stocks again, anticipating a recovery. If their predictions are accurate, they could see significant returns.

Growth (mid cycle): Companies begin reporting positive earnings, but stock returns may be moderate. This is because the stock prices have already risen after their low, and chances for high returns are slim.

Optimism (late cycle): Euphoria drives investments despite stocks being overvalued. At this stage, a market correction becomes imminent → investors tend to sell overpriced assets and book profits.

Where are we now in the cycle & what should our investment strategy be?

You might wonder where we are in the current cycle—but that’s the tricky part. It’s nearly impossible to pinpoint the exact stage in real time; the full picture usually becomes clear only after the fact.

Fortunately, history shows that long-term investors should stick to a simple strategy: invest consistently, diversify, and avoid selling during downturns.

From 1942 to June 2024, the S&P 500 rose 149% during bull markets and dropped just 32% in bear markets. Studies also reveal that those who panic-sell during market dips often delay reinvesting, missing out on significant gains when stocks bounce back.

That’s why it’s usually wise to stay the course, follow your investing plan, and remember that tough times don’t last forever—the cycle always continues.

Until Next Time!