10 MFs that doubled money in the last 3Yrs

Explore mutual funds that have doubled investor’s wealth in three years.

The Indian mutual fund industry has demonstrated remarkable resilience and growth over the past three years, driven by a robust equity market rally and economic recovery post-pandemic. Several mutual funds have not only delivered exceptional returns but also doubled investors’ wealth within this period.

According to data from AMFI and industry experts, some funds have generated an average annual return exceeding 25% CAGR, significantly outpacing broader market indices like the NIFTY 50 and Sensex.

Let's look at the top 10 Indian mutual funds that have delivered doubled investments over the last three years.

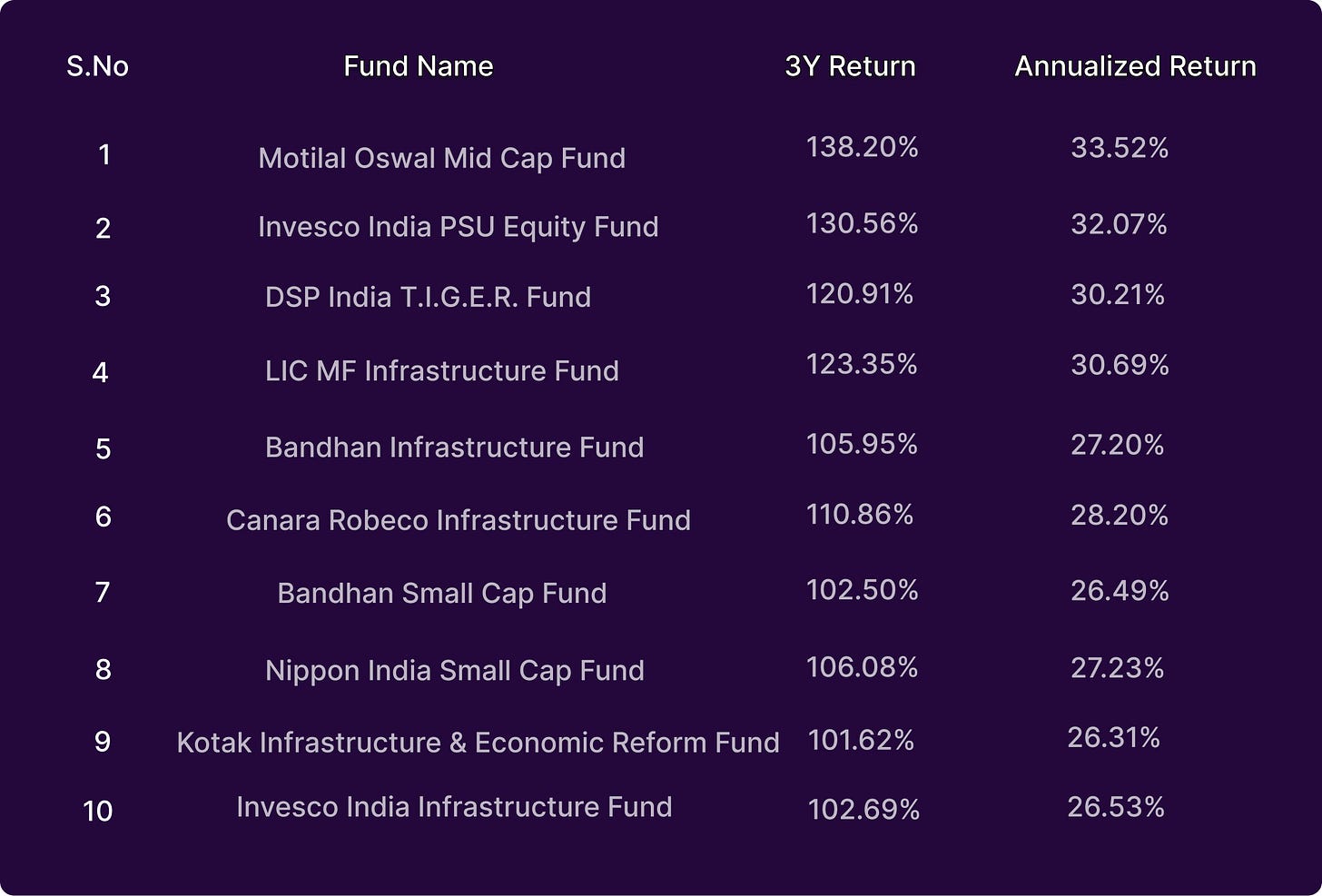

Mutual Funds That Doubled Investor's Wealth In 3 Years

10 mutual funds that doubled wealth in the last 3 years for investors are:

Why Are These Funds Exceptional?

Focused on High-Growth Sectors

Most of these funds concentrated on small-cap, mid-cap, or sectoral themes, which have shown exponential growth in the past three years, capitalizing on India's economic recovery and bullish equity trends.Outperformance vs. Benchmark

These funds consistently beat their respective indices (e.g., NIFTY Small Cap 250, NIFTY Mid Cap 150, BSE India Infrastructure) due to superior stock-picking strategies, disciplined management, and tactical allocation.Long-Term Wealth Creation

While highly volatile in the short term, these funds are tailored for long-term investors who can withstand market fluctuations to reap significant returns.Emerging Market Resilience

India’s robust small and mid-cap ecosystem provided these funds with ample opportunities to invest in businesses that have a disruptive potential.

Conclusion

Investing in mutual funds that double wealth in three years is a dream for every investor. However, it’s essential to remember that such funds usually involve higher risk, making them suitable only for investors with a high risk tolerance and long-term goals.

While past performance does not guarantee future returns, the underlying strategies and sectors driving these funds' exceptional growth offer insights into India’s evolving investment landscape.

With the advantages of professional management, diversification, and relatively lower risk, mutual funds are an ideal investment choice for NRIs seeking both convenience and long-term financial growth. If you are an NRI and want to be part of India's growth story, invest in mutual funds through iNRI.